Kathleen Madigan at the Wall Street Journal claims:

In a speech given Tuesday, the chairman discussed the aggregate hours of production workers, which had fallen by nearly 10% from the beginning of the recent recession through October 2009. “Although hours of work have increased during the expansion,” he said, “this measure still remains about 6 1/2% below its pre-recession level.” In other words, labor markets are nowhere near where they were before the financial collapse and recession.

Output, on the other hand, is fully recovered. Real gross domestic product — which at its worst had shrunk 4.1% — surpassed its 2007 peak at the end of 2010 and expanded further in the first quarter of 2011.

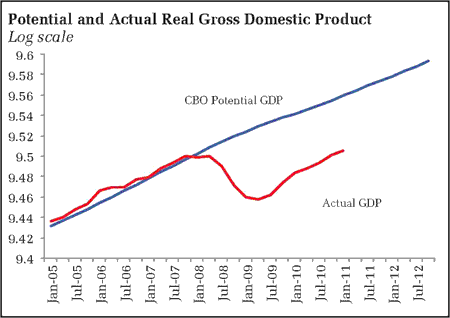

True, output has surpassed its previous peak, but this in no way should be the measure by which we determine if output has fully recovered. Full output recovery would require that activity return to potential output, and by that measure, output recovery remains little more than a fantasy:

See also Mark Thoma’s link to Justin Wolfers. Madigan continues:

The gap between output and jobs is why the economy is in an expansion cycle by economists’ standards — but it doesn’t feel even close to recovery mode for the average consumer.

No, because if the economy were in fact fully recovered, unemployment rates would be at normal levels. Again, just because output regains its previous peak does not mean the economy has recovered. More:

Output has surged ahead of labor because of strong productivity. Robust productivity gains are good for profits and inflation outlook, but bad for workers and consumer spending.

This shouldn’t be true – higher productivity is absolutely not supposed to be bad for workers. It is supposed to allow for higher real wages, higher standards of living. But when aggregate demand falls short of that necessary to compensate for productivity growth, the economy remains mired in persistent disinflationary state, with high levels of unemployment. To solve this, something needs to boost aggregate demand. Not the Federal Reserve, claims Madigan:

Although the Fed is tasked with promoting full employment, there isn’t much the central bank can do at this point to push private businesses to hire.

It’s not that policymakers have no appetite for a third round of quantitative easing. It’s that another round probably isn’t going to help.

The Fed is not powerless, even at this juncture. Arguably, they have not even attempted to ease in line with that required to boost activity further. As Jim Hamilton points out, the numbers involved in QE2 should have been expected to have only a modest impact. The Fed could also raise inflation expectations. And I have always felt the Fed’s repeated insistence that their actions were only temporary helps ensure their policy will be less effectual than would otherwise be the case. Why should banks expand lending when they know the Fed is only going to mop up excess reserves and jerk up the short end of the yield curve the first chance they get?

That the Fed chooses to not take a more aggressive stance should not be confused with the inability to offer additional economic support. And by no means should we trick ourselves into believing that output is fully recovered.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply