Last November, the Federal Reserve announced a plan to purchase $75 billion each month in intermediate-term Treasury securities, a measure popularly described as a second round of quantitative easing, or QE2. June is the last month of this program, and it looks unlikely that the Fed will extend it, causing some observers to be concerned. My view is that QE2 had relatively modest effects, and such benefits as it provided should not evaporate with the end of the purchases.

One of the channels by which QE2 could have been expected to affect the economy is by changing the maturity structure of debt held by the public. The theory is that by taking a large enough volume of long-term debt off the market, the price of long-term bonds might rise, that is, long-term yields might fall. The Fed buys the bonds with newly created Federal Reserve deposits, which in the current environment function essentially like short-term Treasury bills. In the current situation, increasing the supply of these has no effect on short-term yields, so that the purchases on balance might be able to exert some economic stimulus.

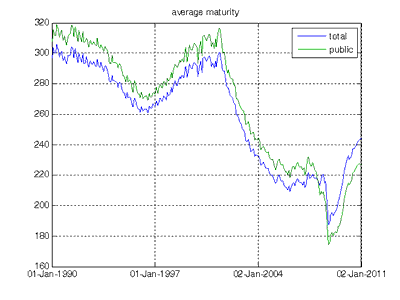

The empirical evidence suggests that there is some potential for this to work, though massive purchases would be necessary to have modest effects on interest rates. The $75 billion purchased monthly by the Fed amounts to about 1% of marketable Treasury debt held by the public. Moreover, under QE2 the Fed has been purchasing intermediate-term rather than long-term debt, and the fact is that the average maturity of publicly held debt has actually been increasing rather than falling during QE2.

Blue: average maturity (in weeks) of marketable nominal U.S. Treasury debt outstanding as of the end of the month, 1990:M1-2011:M1. Green: average maturity of debt other than that held by the Federal Reserve.

Moreover, as Jeff Miller notes, the end of QE2 doesn’t mean the Fed is planning to sell its Treasuries, only that it’s not going to continue to buy new ones.

The other reality to keep in mind is that the Fed simply doesn’t have the ability to solve our current economic problems. The one thing the Fed can and should do is prevent deflation. I think the main success of QE2 was that it helped the Fed to signal convincingly that it had the ability and the will to prevent deflation. But the fact that the Fed is not buying more Treasury bonds should not change any of that.

There are plenty of things to worry about in the current situation. But the end of QE2 shouldn’t be one of them.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply