I read an article recently whose title perfectly summed up my feelings on this once market leading stock: What Will It Take to Move Apple’s Price Again? The stock remains greatly undervalued, with incredible earnings growth considering its size. It continues to innovate with market-creating products like the iPad and iPhone. An explosion two weeks at its Foxconn production plant threatened to affect iPad 2 production, but they have said the incident will have little impact. So why, given all that, has trading been so lackluster in AAPL.

Well, we’ve gotten further evidence today that action in Apple hinges on basically one thing: the health of Steve Jobs. Ever since his latest leave of absence, it has been hard to find new enthusiastic buyers of the stock. I feel it is because everyone has in the back of their mind the idea of a Steve Jobs market crash. Many have predicted that the day Steve Jobs passes away, however far in the future that may be, there will be a massive sell-off in AAPL that, because of the stock’s heavy weighting in stock indices, will reverberate throughout the entire market. Those people are probably right, but although Jobs has had his share of serious health problems, pancreatic cancer among them, there is nothing to indicate his death is imminent.

This morning we got news that Jobs would be giving the keynote address at an Apple event next Monday, and that announcement was immediately met with a spate of buying that has continued unabated throughout the day today. It really is all about Steve Jobs, the iconic CEO and genius credited with engineering the world second largest company by market cap.

Technically, AAPL triggered long for me on Friday when it broke its lower pivot of $337-338 (we went over it in my live Morning Call show this morning). Today stock took off quick with great volume and was an add through $343-344. AAPL diverged, remaining strong while the market pulled in today. The stock gave an additional intraday add entry when it broke the morning high of $344.11.

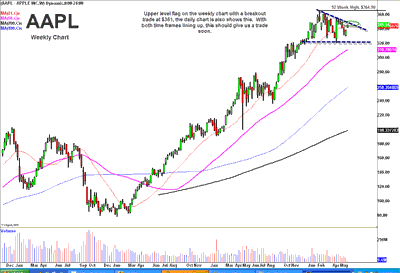

Investors are likely now asking, “Can I still buy AAPL after today’s big move?” For a risk averse active trader, I would say you probably missed most of the party for now, but by no means so I think this is the end of a bigger move. The next big obstacle for AAPL is the descending trendline that’s been controlling the stock since the high on February 16th. This line now stands at $349-351 will be on a more macro level.

A break and close above this level opens the door for a trade back to the highs ($364.90) and then to my eventual macro target I’ve mentioned a few times that stands at $425-$450. Pick your time frame and trade Apple accordingly, but today proves again that this stock is all about Steve Jobs, fair or not.

Disclosure: Long AAPL

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply