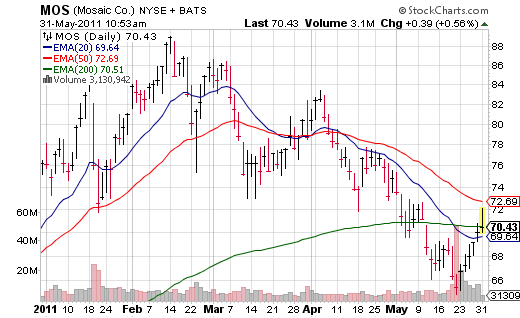

Mosaic Co. (MOS), North America’s largest producer of phosphate fertilizers and its second-largest producer of potash my be worth a look, Barron’s reports. A number of analysts believe there are good reasons to like the stock over the long term. The newly independent—and discounted Mosaic shares, currently trading over $70, fetch just 12.4x projected 2012 profit, a big discount to the 17.4 average for fertilizer stocks and Mosaic’s own median of 16.5x over the past 20 quarters.

The Plymouth, Minn.-based company also has a robust balance sheet with no debt, and nearly $3.4 billion, or $7.50 a share, in cash. Most of the downside risks, such as a oversupply to push phosphate prices down due to weather and a overhang from the distribution of 64% of its shares held by Cargill, appear significantly factored into the stock price.

Shares of Mosaic traded up 49 cents during mid-day trading on Tuesday. The shares have had a greater than 1 percent range day today, with upside that saw the equity print a NHOD of $72.07. Previous close: $70.04.

The median Wall Street price target on MOS is $85.00 with a high target of $102.00.

No Position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply