General Moly, Inc. (GMO) squeezes to new Hod ; move attributed to a potential $15.17 net present value [NPV] scenario presented by GMO on page 10 – for tomorrow’s Goldman Sachs (GS) Basic Material conference. See slideshow here.

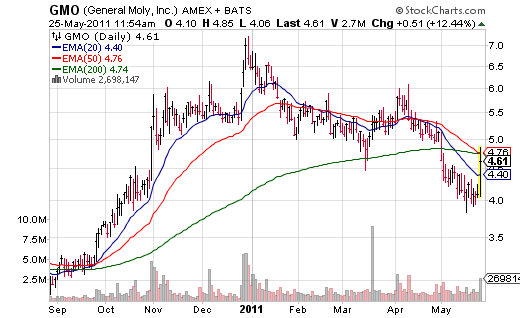

Shares of General Moly Inc., a company that develops and mines molybdenum minerals in the U.S., traded up 15% during mid-day trading on Wednesday, hitting a HOD of $4.85. The stock continues to attract bids as it climbs towards its early intra-day highs near the $4.70 – mid $4.80 levels. There is resistance in this vicinity, but the equity could be on its way higher over the near-term if the bulls can sustain this pivot. Share volume has exploded. Just over halfway through the trading day, more than 2.4 million shares have already changed hands, compared with a three-month daily average volume of 1.18 million shares.

GMO looks to have resistance at the $5.00 area. Even though the ticker has a respectable 52-week gain of 16.82%, the security’s relative short-term slide (Dec. ’10/52wkh $7.25 to May 19/ $4.04) has attracted some bearish attention. Short interest accounts for nearly 8% of GMO’s float, or 5.2 million shares. General Moly would have first major rez at $5.25.

The median Wall Street price target on the stock is $6.70 with a high target of $7.00. At last check, GMO was up $0.53, or 12.93%, to $4.63.

No Position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply