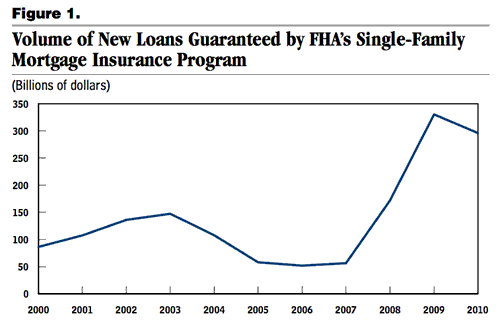

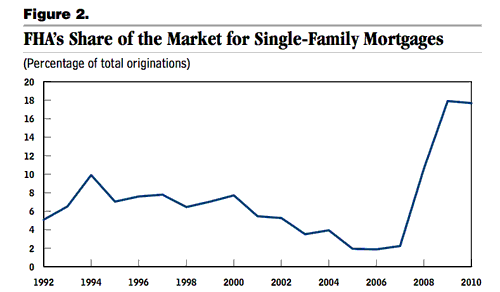

When Fannie and Freddie went down for the count way back in 2008 their (then) little sister, FHA, stepped up to the table in a very big way to fill the void. They succeeded. The FHA book of guaranteed mortgages has exploded since those dark days. From 2007 when FHA had a lousy $50b in new annual issuance they jumped seven fold to $350b in 2009. Where they once had a sleepy 2% market share of US mortgages they now have a very impressive 18%. Their total book of mortgage risk has grown from $427b at the end of 2007 to a very lumpy $1.05 Trillion three years later.

It’s hard to look at those results and call it anything but a screaming success. FHA has been the fastest growing financial institution (by asset size) in the world for the past three years. Way to Go!

But now the bad news. The folks over at the CBO took a look at all this. They did an analysis that looked at how FHA values its book and compared it to Fair Market. Why on earth would the CBO do that? No other financial institution (public or private) has to measure their book based on fair value. So why look at FHA on that basis? Simple answer. The CBO thinks that fair value versus the FHA accounting is a good proxy for the imbedded losses at FHA. From the report:

FHA’s mortgage guarantees expose the government (and ultimately taxpayers) to a significant amount of market risk.

FHA offers guarantees on mortgages with high loan-to- value ratios, which makes the likelihood and severity of defaults very sensitive to even moderate declines in housing prices.

If losses from defaults increase, the increase is likely to occur when the overall economy is weak and the cost of resources to cover those losses is high—a risk that would be reflected in fair-value estimates.

The full analysis by CBO is here (link). You can draw your own conclusions. I’ll cut to the chase and give you the last sentence:

The difference (between FHA and fair value)—1.5 percent of the initial loan amount—is the fair-value subsidy rate for the program.

At a rate of $300b+ of new business a year the FHA subsidy is pushing $5b a year.

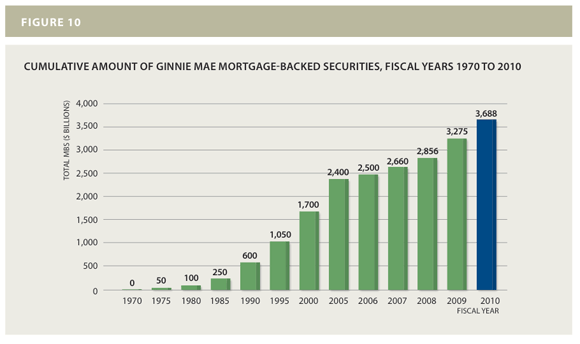

In its annual report the FHA proudly showed this chart of the cumulative issuance of Ginnie Mae securities (FHA gteed loans). The total is a whopping $3.7 Trillion. If the 1.5% subsidy is applied to the entire book of business it comes to $55 billion. Anyone wonder why we are going broke?

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply