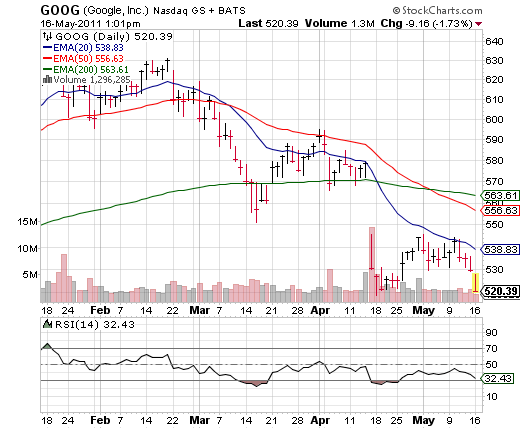

Shares of Google (GOOG) are trading lower by $7.00 to $522.60 a share in midday trading. The stock hit a low of $521.12 earlier in the day and continues to extend gap down start as it builds a lower pivot range. The equity remains under pressure despite finding initial support along its $521.00-area on the initial drop. Next area of interest for the ticker lies around the $519.00 heavy support area, which is also its April – eight month intraday low. Should GOOG find some support as it trades through these lower levels and do an intraday reversal, which for the moment seems highly unlikely, traders will have to watch for some resistance around the $525.00 area.

Since rallying to a new 52-wkh of $642.96 in January, the equity has taken a breather from its quest for higher highs, and is now attempting to setup a short-term floorboard in the $519.00 – 520.00 area.

From a valuation perspective, GOOG doesn’t appear expensive. The shares trade at a trailing P/E of 20.18, a forward P/E of 13.14 and a P/E to Growth ratio of 0.89. The median Wall Street price target on the stock is $700.00 with a high target of $800.00.

No Position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply