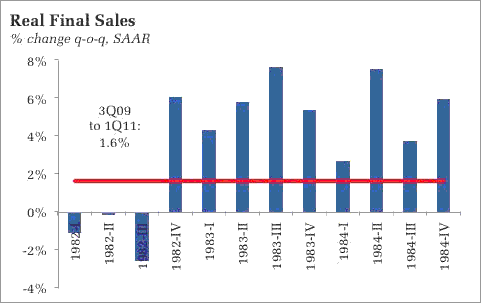

The first quarter GDP number was profoundly disappointing. I always look back to the benchmark of the mid-80’s to measure the pace of the recovery, paying close attention to real final sales:

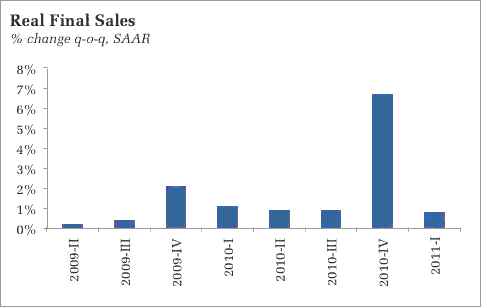

The pace of the current recovery pales by comparison. Indeed, even the meager 1.6% average final sales growth is inflated by the blowout 6.7% gain in the final quarter of last year. Excluding that quarter, the average is a miserable 0.9%. It was the that fourth quarter data that gave me hope the economy was actually turning a corner; that hope was so quickly dashed:

Headline GDP grew at an average of 2.45% over the past two quarters, at the lower end of estimates of potential growth. This is consistent with the numbers the labor market has been churning out in recent months, and hence it seems difficult to expect little change in the April employment report. Note the possibility for disappointment; as the economy has lost momentum, initial unemployment claims began to stagnate in April.

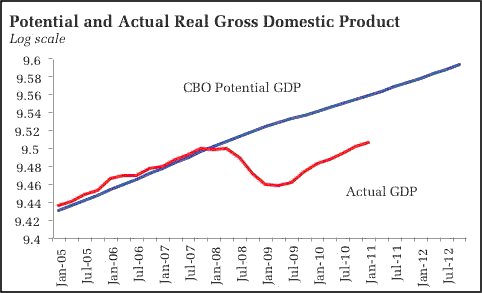

In the absence of dramatically faster growth, the output gap remains distressingly large:

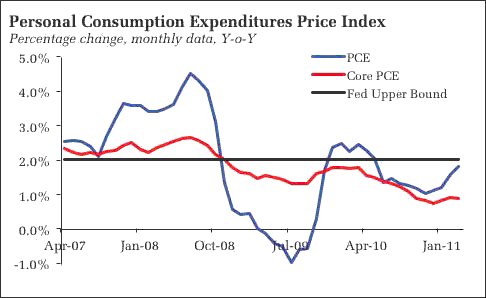

Moreover, year-over-year core inflation remains well contained:

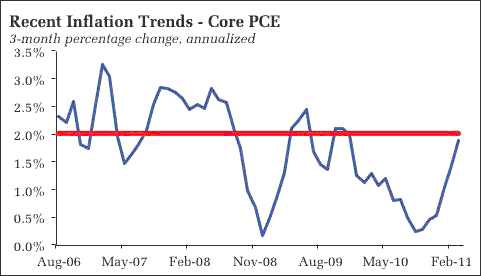

Near term core inflation, however, has edged up:

This is not surprising given pass-through from higher commodity prices, which, as noted by Calculated Risk, may already be easing. That near-term inflation rise, however, was enough to spook the Federal Reserve – the Bernanke word cloud reveals his emphasis on inflation as the inaugural press conference. St. Louis Federal Reserve President James Bullard was first out of the gate in the wake of last week’s FOMC meeting to entrench expectations of tightening by the end of this year:

“We do have rising inflation and rising inflation expectations making me a little bit nervous,” Bullard said. “We’ve got to start taking some steps to start to tighten monetary policy as we continue on through 2011 to make sure we don’t allow inflation to get away from us.”

Bullard is a growth optimist:

The economy is likely to pick up speed following a slowdown at the start of the year, Bullard said, predicting gross domestic product will end rising 3.5% in 2011. Economic growth slowed to an annual 1.8% in the first quarter from 3.1% at the end of last year as higher prices, especially for gasoline and food, squeezed consumer spending in other areas.

I use the term optimist loosely. Note that if the economy grows 3.5%, the output gap closes by at best just one percentage point, so an the output gap of roughly 4.3% of GDP remains more than two years after the recession ended. This suggests the undercurrent is strongly disinflationary even if the commodity price jump places temporary upward pressure on inflation. It seems inconceivable in this environment, and with the Fed actually still easing, that policymakers are eager to reinforce expectations that tightening is imminent and thus work to nullify the easing before it actually occurs. Yet this is indeed the current state of policy.

Bottom Line: The die appears to be cast; the Fed is poised to complete QE2 by mid-year and then turn attention to tightening. We will be searching the data to see how much Q1 weakness is transitory. If it is more than transitory, and growth forecasts for the full year begin to trend down toward potential, the Fed will find itself again delaying a turn to tightening. But even if growth disappoints, until inflation begins to recede, any further easing looks off the table.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply