A “W” Recession?

Martin Feldstein has recently raised the possibility that we might experience a relapse into recession in 2010 (a perfect symmetrical W), with the next dip in 2010. In my view, this means (1) we should have opted for a bigger and better composed stimulus package, and (2) the timing of expenditures in the stimulus package might not be as problematic as many commentators have indicated.

“I think we”re going to see a temporary substantial improvement,” Feldstein, the former head of the National Bureau of Economic Research and a Reagan administration adviser, said today in an interview on Bloomberg Radio. “I emphasize the words temporary and substantial.”

Feldstein — a member of the private panel that dates the start of recessions and recoveries — suggested the economy will contract into next year, and that the pattern of economic turnaround will be more of a seesaw than what he called “a beautiful symmetrical W.”

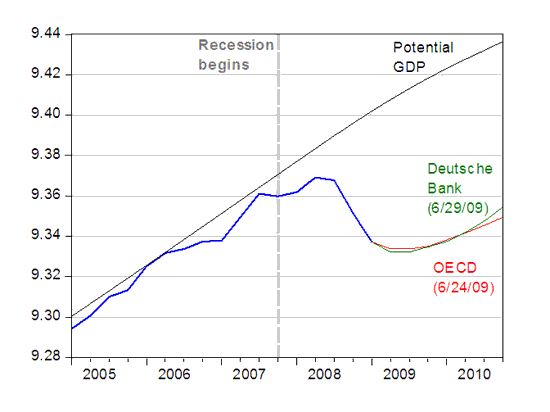

Interestingly, neither the OECD nor Deutsche Bank project such a “W” shaped trajectory. Nor do any of the forecasters in the May WSJ survey.

Figure 1: Log real GDP (blue), OECD forecast of 24 June (red), Deutsche Bank forecast of 29 June (green), and CBO estimate of potential GDP of January 2009 (black). NBER defined recession dates shaded gray. Source: BEA, 2009Q1 final release, OECD, Economic Outlook No. 85, Deutsche Bank, “World Outlook: Recovery Ahead,” Global Markets Research (June 29, 2009).

That doesn’t rule out the possibility of this occurring. I can think of several reasons for thinking a W shaped recession would be plausible. The most plausible in my mind would be if the world economy failed to rebound sufficiently to provide enough externally generated aggregate demand via exports. The other possibility is that monetary policy tightens too soon, as inflation hawks press their case (see FRBSF President Janet Yellen’s assessment, as well as this post).

The Timing of Stimulus Spending, Again

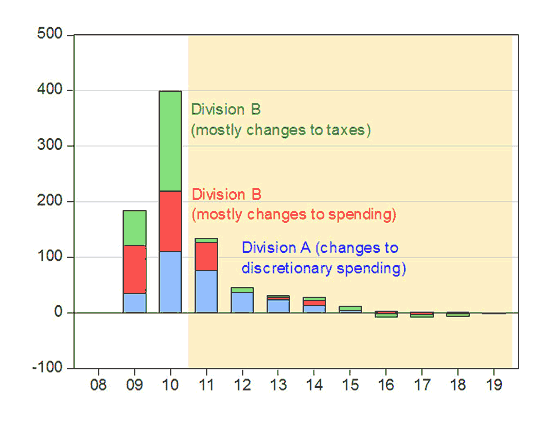

At this juncture, it’s useful to recall that the peak in spending would be in FY2010. As shown in this figure from this post, roughly half of the stimulus occurs in from October 2009 to September 2010.

Figure 2: Estimated spending and tax revenue reductions, per fiscal year, embodied in HR 1 final version. Shaded areas pertain to spending occurring outside of the 19.5 month time frame. Source: CBO, H.R. 1, American Recovery and Reinvestment Act of 2009 (February 13, 2009).

I know that there’s going to be a big group of commentators who will argue the multiplier is 0, but I’ll go with the CBO and assert there will be some impact of indeterminate amount. In addition, if the critics who have argued that the spending is occurring much too slowly are correct [0], then the actual spending will more likely occur in this “dip” period that Feldstein is predicting. (Previously, I argued that the recession was likely to be long, so speed would not be of the essence [1]).

Mendacity Alert

Figure 1 also demonstrates why the critics of the stimulus bill that cite today’s nonfarm payroll losses are being disingenuous. It was understood that most of the spending would not occur in FY2009, and even that which occurred within FY2009 would be toward the end of the year. (Really, did anyone expect the impact to be discernable in four months after the bill’s passage?).

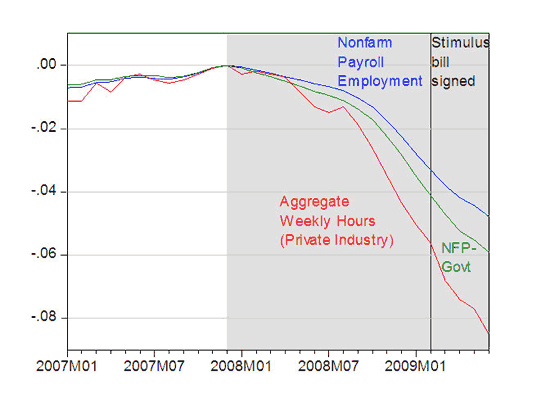

Figure 3: Log nonfarm payroll employment (blue), log nonfarm payroll employment minus government workers (green), log aggregate weekly hours in private industry (red), all normalized to zero in 2007M12. NBER defined recession date shaded gray, assuming the recession end has not arrived by June 2009. Vertical black line denotes ARRA signed into law in February. Source: BLS, Employment Situation June release.

The series in Figure 3 are plotted in log terms. This means that changes in the slope indicate changes in the percentage rate of change in the indices. The fact that the slopes for the blue and green lines means the rate of deterioration in employment is declining. However, there was little evidence before that the labor market was improving even before this morning’s release [2], and that point is reiterated today by Jeff Frankel.

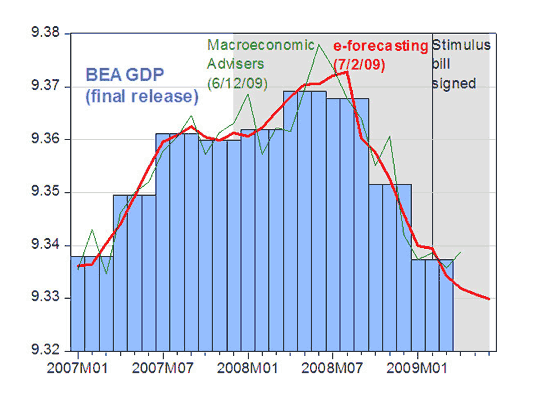

Interestingly, if the critics of the stimulus bill focus on changes in trends post ARRA [i] [ii] [iii], they might regret it in the future (well, assuming they’re interested in internal consistency of argument). That’s because the rate of GDP decline does look like it’s stabilizing in 2009Q2, at least based on early readings from e-forecasting and Macroeconomic Advisers. (Once again, the series are plotted in log terms, so changes in slope can be identified as changes in the percentage growth rates.)

Figure 4: Log real GDP from BEA (blue bars), and Macroeconomic Advisers 6/12 (green line), e-forecasting 7/2 (thick red line), all in Ch.2000$, SAAR. NBER defined recession date shaded gray, assuming the recession end has not arrived by June 2009. Vertical black line denotes ARRA signed into law in February. Source: BEA, GDP 2009Q1 final release; Macroeconomic Advisers [xls], e-forecasting, and NBER.

Valid, and Not so Valid, Criticisms of the Stimulus Bill

I do think the one big failings of the stimulus package that I highlighted back in March is now coming to light: the cut in the transfers to states that came about as a result of the compromise with the Senate Republican moderates [3]. As the states grapple with truly challenging budget shortfalls [4] [5] [6], they are cutting spending and raising taxes – exactly the measures that the textbooks say are not ideal from a countercyclical stabilization policy standpoint.

One digression on bureaucratic procedures. In the day before yesterday’s NYT, David Leonhardt chastises the Administration for using models that were too optimistic. I certainly agree in retrospect the Administration’s baseline forecast was too optimistic. Two observations: First, it’s important to realize that the end-February assessments were based upon early January forecasts completed by the previous (Bush) Administration, and finalized on February 3 [7]. When taken in that light, I don’t believe the forecasts were that much out of line with private sector forecasts [8]. Second, (in my limited experience) if one is to deviate from a model, it helps to have a formal alternative model to use. It’s not clear to me an alternative formal model that had widespread acceptance exists, so, it’s all fine and good to say a more pessimistic model should’ve been used, but it’s hard to make a case for that in a bureaucratic setting, especially if it deviated from the Blue Chip.

Back to the Stimulus Debate: W, Timing, the States, and Baselines

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply