The data flow can be characterized as generally good from a growth perspective and generally bad from a levels perspective. Fed policymakers who focus on the former will tend toward removing policy accommodation sooner than later. Those who focus on the latter tend toward the opposite. I think the key decision makers, notably Federal Reserve Chairman Ben Bernanke, will be in the second group, leading the Fed to finish up with the current asset purchase program as scheduled before moving to the sidelines.

Start with the good. The March employment report tells a story not unlike the February report, but without the ability to dismiss it as simply an artifact of weather related disruptions in January. Private sector job growth continues to compensate for weakness on the government side, sustaining net overall job growth at a monthly average of 159k during the first quarter. This was a tad better than the 139k average of the final quarter of last year and consistent with declining initial unemployment claims. Overall, nonfarm payrolls data suggest the economy fell into a more sustainable growth path at the end of last year, near trend growth, perhaps a little above as the first quarter came to a close.

If we focus on the underlying trends, rather than getting bogged down in volatile month-to-month or quarter-to-quarter numbers, it looks as though the cyclical tide has turned. The manufacturing surveys, including the most recent ISM report on manufacturing, remain well into solid territory. It can be argued that the March dip in auto sales forewarns of the negative impact of higher energy prices, but also should be taken in context of a solid gain in February. Also, note the rising confidence among CEO’s:

Optimism among U.S. chief executive officers surpassed the highest level reached before the recession as more business leaders projected increased sales, investment and hiring, a survey showed.

The Business Roundtable’s economic outlook index increased to 113 in the first quarter, the highest point since records began in 2002, from 101 in the previous three months, the Washington-based group said today. Readings greater than 50 coincide with an economic expansion. The previous peak was 104 in the first three months of 2005.

…Fifty-two percent of CEOs said they will add to payrolls, up from 45 percent in the fourth quarter and the largest share on record. Some 62 percent said they plan to spend more on equipment, up from 59 percent.

…The chief executives in the Business Roundtable survey forecast U.S. economic growth of 2.9 percent this year compared with the 2.5 percent projection in the previous survey.

All generally good news, and the growth forecast is consistent with trend growth. Hold onto the number, though – we will need it later.

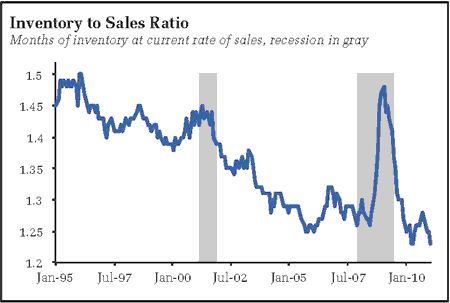

Finally, keep an eye on inventories –which were depleted at the beginning of this year:

If firms were experiencing a sharp drop in demand, and thus an increase in unexpected inventories, I find it challenging to believe they would continue to add workers in February and March. Instead, firms are probably trying to make up lost inventory ground, which will support the sustainability of the recovery going forward.

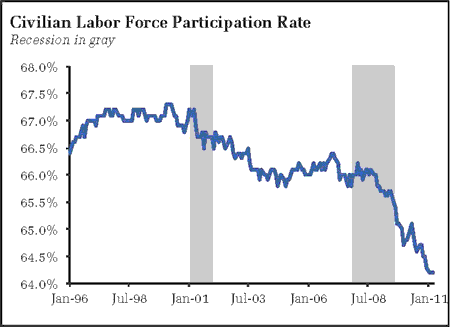

In sum, the economy looks to be on, as the Fed describes, “firmer footing.” Definitely good. But definitely not without warts. Housing, for example – a market that just won’t heal in light of a very big structural change toward tighter underwriting conditions. Yet the biggest wart is simply that the pace of growth appears to ensure the economy operates far below potential for far too long. This is the “bad.” As a consequence, unemployment is retreating slowly. Arguably, we wouldn’t mind if unemployment increased a bit if growth was sufficiently strong to draw a mass of persons back into the labor force. But labor force participation fell to 64.2 percent and held there for three months:

Likewise, the employment to population ratio shows no indication of rebounding to prerecession levels anytime soon. At this rate of recovery, I am generally worried that the next decade will prove to be once again “jobless,” that nonfarm payrolls will once again remain stagnant by the time we are near the trough of the next recession. Maybe this is what inevitably becomes of aging economies.

The palpable weakness of the labor market reveals itself in stagnant wage growth. Average hourly earnings gained just a penny in February, and nothing in March. Workers might be feeling the effect of headline inflation, but apparently have absolutely no power to respond with anything but belt tightening. The lack of wage growth is simply the biggest hole in the inflation story, as it suggests that underlying inflation inertia is practically nonexistent. That this is not obvious to all monetary policymakers is somewhat shocking. spencer at Angry Bear puts it succinctly:

The combination of expanding hours and very weak wage gains generated an increase in average weekly earnings. But the year over year increase in average weekly earnings is only 2.87% this month versus 2.98% in February. With weekly earnings only growing at under a 3% rate it is hard to see how firms can pass higher commodity prices through to consumers.

The inflation hawks seem to be ignoring the point that higher prices or inflation is most likely to generate weak consumption, not sustained higher inflation. Managers and analysts appear to be far too optimistic about firms ability to raise prices.

spencer is referring to the contingent of Fed speakers who appear to be organizing in favor of an imminent tightening of policy. This directly impacts expectations of market participants. From the Wall Street Journal:

..Several officials, such as Mr. Kocherlakota, have given individual interviews to news organizations, adding up to hundreds of newswire headlines that have jarred some traders. Many of the most vocal—as is often the case—have been inflation hawks, who tend to favor higher interest rates to beat back rising consumer prices.

“People in the market have been getting freaked out,” said Michael Feroli, chief U.S. economist with J.P. Morgan. “There is this view that Washington has sent out some memo to coordinate everyone to start talking hawkishly.” He said he’s skeptical of that view.

Feroli is right to be skeptical:

The Fed regional bank presidents generally speak for themselves, not the central bank as a whole, and typically don’t coordinate their messages with each other or the Fed board in Washington.

Some Fed officials have been frustrated in recent years with a tendency of colleagues, often regional bank presidents, to stake out policy positions in public rather than within the closed-door Federal Open Market Committee, where the decisions are made.

It would not be a surprise if market participants were likewise rattled by the contents of the March 15 FOMC meeting minutes, to be released today, as the hawks may have been vocal at the meeting. Still, the hawkish rhetoric will likely not yield much policy traction. New York Fed President William Dudley, widely believed to be a key decision maker, sent a clear message about the direction of policy:

To sum up, economic conditions have improved in the past year. Yet, the recovery is still tenuous. And, we are still far from the mark with regard to the Fed’s dual mandate. In particular, the unemployment rate is much too high.

Thinking ahead, unemployment may only be one hurdle. When unemployment is on a solid downtrend, Fed officials may turn to labor costs before tightening the screws.

Another point – note that Fed’s GDP forecast for this year is 3.4 to 3.9%. This is up to a full percentage point above that expected by CEOs (refer to above). And, at the moment, I would argue the labor market data is consistent with sustained growth maybe a bit above the potential growth range of 2.5 to 2.8%. Thus, growth looks to be falling short of the Fed’s forecasts, arguing for sustained policy accommodation.

Finally, we need to consider the likely position of Federal Reserve Chairman Ben Bernanke. It is difficult to believe that an academic so knowledgeable about the history of the Great Depression would be eager to repeat the mistakes of 1937. Nor would he be likely to confuse a change in relative prices with an outbreak of accelerating inflation. Nor would he fail to recognize the importance of wages in setting in motion accelerating inflation. Nor would he ignore the depth of the labor market hole. And, I would hope, that he is already beginning to see the possibility of another jobless decade unless we can quickly and definitively surpass the previous employment peak (never too early to think about the outcome of the next recession, even while riding the current wave upward). All of which suggests he will not be leading the charge toward tightening anytime soon.

Bottom Line: Monetary tightening will come. At least, we all hope it will. I shudder at the prospect of being stuck here for another three years. But I think it premature to expect that tightening anytime soon. The core of the Fed will keep focused on the pace of growth relative to the depth of the recovery. The current recovery may be sustainable, but continues to fall short of that necessary to propel output and employment to prerecession trends. And clearly short of that necessary to induce more rapid wage gains. The data simply are not there to justify a monetary policy shift at this juncture.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply