Goldman Sachs analyst Tim Boddy, the long-term Nokia (NYSE:NOK) bear is upgrading the name this morning to a Buy from Neutral with a $12.40 price target, representing 47% upside.

Nokia’s stock price is down 80% from 2007 highs as it failed to execute on its strategy of becoming an integrated competitor to Apple and Google. Given the strong network effects enjoyed by rival ecosystems, Goldman now believes the decision to focus on smartphone hardware design, assembly and distribution is appropriate and returns Nokia to its core competencies. Despite likely near-term volatility as it goes through a difficult 12-18-month transition period, they believe that cost reduction can be larger than investors anticipate, while the collapse in handset market share and margins implied by the valuation is excessive.

Nokia has large cost cutting potential, a pre-requisite for success

A study of successful Tech hardware ‘turnarounds’ by new CEOs in the last decade (e.g., Xerox in 2002-05, Ericsson in 2003-06, HP in 2005-08, Gemalto in 2006-09) suggests that dramatic cost reduction is a pre-requisite for a transformation of a company’s earnings power. A healthy or improving macro/demand environment is also important, but the key long-term issue is whether or not secular pressures absorb efficiency gains (e.g., Motorola and Nortel in 2003-04, Alcatel-Lucent and Nortel in 2007-08, or Ericsson in 2007).

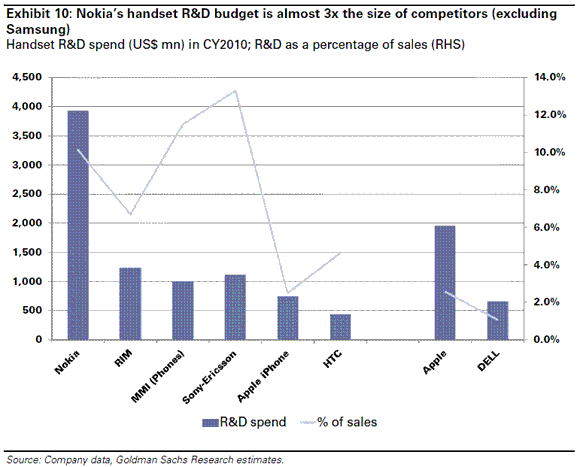

In this context Goldman’s benchmarking analysis vs. handset peers suggests that Nokia spends almost $3 bn more than leading competitors on R&D, which they believe creates a substantial cost-cutting opportunity. With Nokia now relying on Microsoft for software development and most ‘cloud’ services, even taking into account Nokia’s geographic reach and breadth of products they see scope for at least €1 bn in cost reduction over the next 12-18 months. Importantly, Nokia’s robust balance sheet means it can absorb nearterm losses in the process.

See a floor for L/T smartphone share, high single digit margins

With Microsoft an unproven partner, Goldman assumes that Nokia continues to lose smartphone market share at a dramatic pace, with smartphone volume/value share approximately halving from 37%/22% in 2010 to 17%/13% in 2013. Although execution risk is high, and Microsoft’s track record in mobile weak, the firm sees several reasons why investors should believe that Nokia’s smartphone share can eventually bottom (likely in mid-2012):

– Microsoft’s $22 bn annual free cash flow and $37 bn cash pile means it can afford to invest aggressively in a market critical to its future. As a result, Microsoft will likely be one of the leading providers of ‘cloud’ services to consumers (email, search, apps, games, storage, etc) longer-term, and the firm assumes it achieves c.20% share of the overall smartphone market.

– Nokia’s brand is stronger than Microsoft’s in emerging markets (60% of Nokia’s sales), mitigating the risks created by Microsoft’s mixed developed-market brand perception.

– Goldman believes that Nokia’s expertise in low-cost handset development and its scale will allow Microsoft to move Windows 7/8 rapidly to lower price tiers.

– Microsoft can help Nokia gain share in the Enterprise, historically a weak spot.

Despite the likely commoditised nature of the end market, they forecast high single digit long-term smartphone margins for Nokia, reflecting aggressive cost reduction, its success in extracting a share of services/software value from Microsoft in the form of c.$500 mn estimated annual marketing subsidies and its robust intellectual property rights position.

Basic mobile phones share to recover, double digit margins

Attention naturally focuses on smartphones, but in 2010 48% of Device revenues and around two thirds of profits were generated by Nokia’s ‘basic’ Mobile Phones division. Although this business will likely be progressively cannibalized by smartphones, recent ASP stabilization has gone largely un-noticed as Nokia enjoys a product cycle with lowend touch/Qwerty products. Goldman also sees scope for Nokia to materially recover lost market share as it enters the multi-SIM market (as much as 40% of end-demand in India). They see little change in the economics of this business for Nokia, and expect its scale dominance and increased investments in low-cost Internet services to sustain 10%+ EBIT margins.

Nokia’s CEO is highly incentivized to deliver change

If Nokia’s stock price is between €9 and €17 by end-2012, they estimate that the CEO will earn between €8 mn and €39 mn above his ‘baseline’ cumulative compensation of c.€10 mn for the 2010-12 period. They believe that increasing Nokia’s time to market is critical given a track-record of missing key market innovations. Potentially, this could require a more wholesale change of senior management than the February ‘reshuffle’ delivered

Valuation discounts a collapse in share, ‘automotive’ future

Goldman thinks the risk that cost savings are absorbed by falling revenues and gross margins has been discounted by the market. Assuming 0.4x EV/sales for NSN, and 3x EV/sales from NavteQ, they estimate that Nokia shares are currently pricing in a near halving of handset value market share to 10%, and only 3% EBIT margins. As a result Nokia is now nearing the trough valuation levels experienced historically by PC makers/Tech hardware peers, or by structurally challenged industries like Automobiles. Given their belief that Nokia can stabilize its long-term handset value share in the mid/high teens, and achieve high single digit overall handset EBIT margins, they apply a 0.7x EV/sales multiple for Devices to reach their new 12-month price target of €8.8 (ADR $12.40).

Worst case, Goldman sees downside to €4.5/share if Nokia or Microsoft fail to execute and the stock falls to a PC-industry historical trough of 0.3x sales. Best-case upside is €13/share if Nokia can retain 20% value share and earn 10%+ EBIT margins.

Notablecalls: With the stock down 80% from 2007 highs, the sharks are starting to circulate. I think it close to impossible to know how the whole mobile space will evolve in the coming years but as a rule of thumb you start buying former market leaders when they are down 80-90% from highs. You make the leap of faith.

Goldman has been a long-term bear & with them turning positive on Nokia, I think people will take notice. Also, Goldman is gaming the n-t expectations telling clients to expect below-consensus #’s. That takes some juice out of the n-t bear case.

All in all, I think NOK can be bought here for a trade (& possibly looked as an investment).

I’m expecting an outsized move in NOK today, possibly in the $8.75 range. This may feel as a stretch at first glance but when you think about it, it does make some sense.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply