Shares of OmniVision Technologies (OVTI) soared 27%, the most intraday since February 2004, after the company’s third quarter profits blew past estimates. The maker of image sensors for camera phones reported an adjusted EPS of $0.84, a full 26 cents better than expected. For the current quarter the company forecast revenue well ahead of estimates, in a range of $240 million to $260 million, ahead of the average $219 million estimate. OVTi said it sees Q4 earnings at least at $0.57 a share and as much as $0.70.

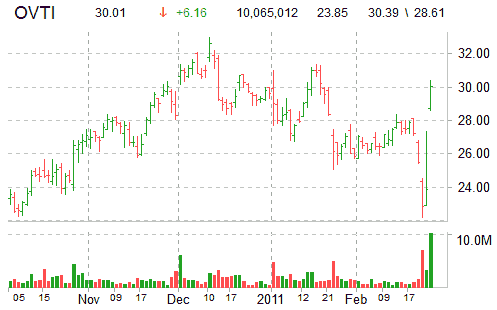

Technically speaking, OVTI continues to climb higher midday, notching a fresh February high above $27.87 to surpass its 200-day simple moving average which is located right around $27.95 level. OVTI stock is currently trading higher by $6.12 to $29.97 a share. Traders can watch the $28 area for a near term pullback. However, with the shares up more than 26% in the wake of today’s report, OVTI could soon be testing its 52wk high of $33.00 (analysts at JPMorgan (JPM) upgraded the stock to ‘Overweight’ from ‘Neutral’ and raised the PPS target to $37.00).

From a valuation perspective, OVTI trades at a trailing P/E of 30.97, a forward P/E of 12.87 and a P/E to Growth ratio of 1.27. The median Wall Street price target on the stock is $35.00 with a high target of $40.00.

The stock continues to trade on a high trading volume. Just over halfway through the trading day, more than 10 million OVTI shares have already changed hands, compared with a three-month daily average of 1.8 million shares.

No Position

Leave a Reply