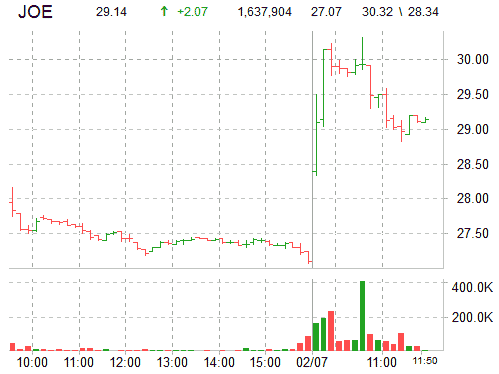

Shares of the St. Joe Company (JOE) jumped more than 10% Monday after CNBC reported that Bruce Berkowitz, head of mutual fund firm Fairholme Capital Management, wants to restructure and lead the Florida-based real estate developer. Mr. Berkowitz is proposing to remove the co.’s Chairman, Hugh Durden, and three other directors and name himself Chairman and Charles Fernandez, president of Fairholme, Vice Chairman of the Board.

CNBC said the Board of Directors had been advised of Berkowitz’s plans.

Shares of JOE are higher on the session by $2.23, currently trading at $29.30. Bruce Berkowitz, who owns 29.7% of the company, is trying to induce a massive short squeeze in the stock. Back in October shares of St. Joe took a beating after David Einhorn, best known for shorting Lehman Brothers (LEHMQ.PK) and profiting when the investment firm collapsed in 2008, said at an investor conference in New York that St. Joe’s stock is worth $7 – $10 a share. Einhorn claimed St. Joe was trading at nearly 3x its intrinsic worth, prompting the security to tumble nearly 30%.

In its share capital JOE has 92.62 million outstanding shares among them 91.89 million shares have been floated in market exchange. Short interest stands at over 66%. That’s a lot.

Another Einhorn take-down?

No Position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply