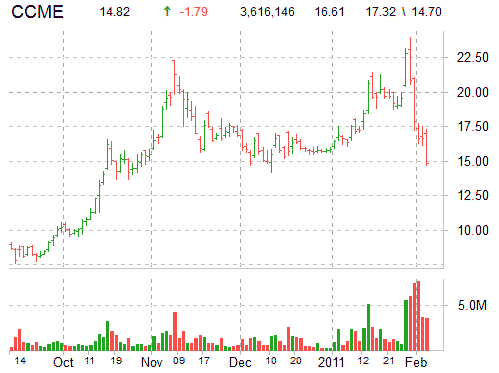

China MediaExpress Holdings, Inc. (CCME) continues to nosedive. Ticker is trading near session lows on heavy volume. Selloff attributed to a Muddy Waters report that has initiated coverage on the shares of China MediaExpress with a “Strong Sell” rating and an estimated value of $5.28.

Volume has exploded with more than 6.4 million CCME shares already trading hands compared to a daily average volume of 1.7 million. The day’s trading range for the ticker has been between $13.62 and $17.32 per share.

CCME currently trades at a trailing P/E of 6.22 a forward P/E of 4.93 and a P/E to Growth ratio of 0.38. The median Wall Street price target on the name is $29.00 with a high target of $32.00.

At last check, CCME was down $2.36, or 14.21%, to $14.30.

China MediaExpress Holdings, Inc. provides television advertising network on inter-city express buses in China. The co. is headquartered in Fuzhou, the People’s Republic of China.

No Position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

They publish the report on the first day of Chinese New Year, not a day before or a day after it. Ask yourself why. And also ask yourself why there are 3 short reports within a week?

What kind of punishment do short sellers get when they are wrong? None. But the rewards is astonishing disregard on whether they are right or wrong. Short at $20, cover at $11! Maybe this is the best low risk high return “investment”.

If a short seller is wrong, they get burned. The risk is unlimited, unless you can spot a pump and dump. What if you buy a stock and it goes down???

YO ARE 100 % CORRECT

THIS WAS TO CAUSE MASSIVE SELL OFF AND THEY SUCCEEDED

should expect someone from CCME to respond tonight. this company is real and there are screens on all the buses in china.

The long contributed to the massive fall off yesterday due to lack of confidence and lack of discipline. Some of them panic and sell. Some of them is not panic but have been margin called.