It’s a big day for markets today, with the results of the ECB’s long-term refinancing operation and the June FOMC meeting released today. The juxtaposition of the two events is curious, to say the least. The Fed, having been exocriated in some quarters for expanding its balance sheet so aggressively, will likely ease off the accelerator at 7.15 London time this evening, mere hours after the ECB loans “your amount” of euros for a year at the low, low rate of 1%.

In each case, the CBs will have expanded the balance sheet aggressively, yet a market that has been more than happy to shag the dollar over the past three months appears to yawning at the prospect of a cheap money bonanza from the ECB.

In each case, the CBs will have expanded the balance sheet aggressively, yet a market that has been more than happy to shag the dollar over the past three months appears to yawning at the prospect of a cheap money bonanza from the ECB.

Well, not everyone is yawning; Macro Man is pleased to provide readers with a live photo feed from Frankfurt as the German Landesbanks receive their funding from the ECB. For some, at least, today’s tender is a wheelie big deal. (Boom, boom.)

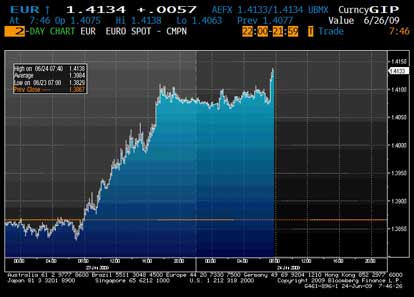

Indeed, the euro has (seemingly perversely) gone strongly bid in the 24 hours before the ECB’s tender. Foreign exchange is such a fun market! The reason for the rally is a highly prosaic one; there appears to be a large EUR/USD buy program emanating from the Middle East.

As for the Fed, it seems as if a consensus has coalesced around the view that the FOMC will stop short of increasing its Treasury-purchase program (though they might decide to sttrrreeeeeetttcccchhhhh out the existing one) and announcing that rates will remain ultra-low for a “considerable period” (or some other such hackneyed phrase) of time. Perhaps they will collapse all of the alphabet-soup programs into one simple facility, though Macro Man isn’t sure that there should necessarily be a market consequence of doing so.

In any event, the rationale for keeping rates lower for longer should start to emerge more forcefully in the data now that markt forecasts have caught up with the green shoots mularkey. Somewhat ominously, the ABC consumer confidence data released last night showed a relapse towards the lows, while Friday’s personal consumption data should show that a large portion of the stimulus bonanza is saved, not spent.

Meanwhile, perhaps it’s a coincidence that demand in yesterday’s two year auction was gangbusters as the SPX was trading below 900….but then again, maybe not. Insofar as higher mortgage rates would now appear to pose a larger threat to economic recovery than lower stock prices, mightn’t the Federales now countenace an equity markt sell-off to provide a bid to bonds? Inquiring minds want to know.

In any event, the drumbeat of protectionism continues to provide a somewhat ominous undercurrent to the green shoots love-in. In a rare show of unananimity, the US and Europe have had a moan about China to the WTO, while Japan’s latest trade data suggests that the rest of Asia has yet to feel the love from China’s recovery. Judge for yourself what this means for risk assets….Macro Man knows which way he’s leaning.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply