Strategic Diagnostics Inc. (SDIX) continues to attract bids as it climbs over its early May 52-week highs of $2.25. SDIX announced Wednesday morning that its RapidChek SELECT Salmonella Enteritidis test system has been reviewed by the U.S. Food and Drug Administration (FDA) and determined to be equivalent in accuracy, precision and sensitivity to their current standard methods for poultry house environmental drag swabs and pooled egg testing.

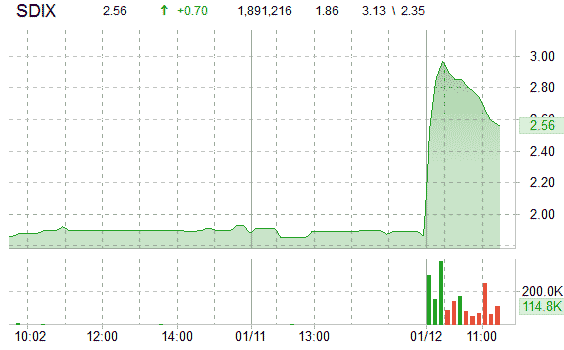

Shares of Strategic Diagnostics gapped up at the open Wednesday. The stock continue to rip higher, now up more than 43% and currently trading at $2.66 per share. Volume has exploded with more than 1.9 million shares already trading hands compared to a daily average volume of just 32,000, the highest volume of the year.

Today’s trading range for shares of SDIX has been between $2.35 and $3.13 per share.

Strategic Diagnostics Inc. was founded in 1987. The biotech company, together with its subsidiaries, develops, manufactures, and markets proprietary products food safety in the pharmal, biotechnology, diagnostics and environmental markets.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply