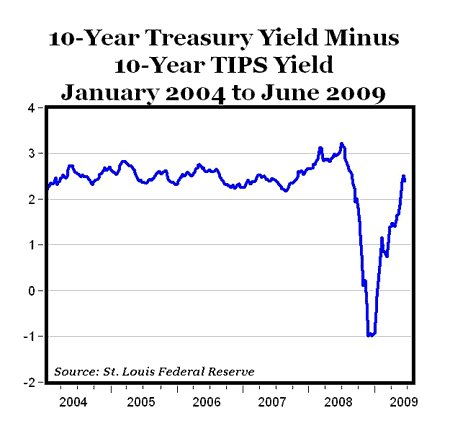

The chart above shows the weekly, bond market-based 10-year TIPS-derived expected inflation, calculated as the difference between 10-year regular, nominal Treasury yields and 10-year Treasury inflation-indexed yields (St. Louis Fed data here). After a unusual period in late 2008 resulting in a negative spread when the TIPS 10-year yields were above 4%, and higher than regular Treasury yields of about 2%, the Treasury market seems to have stabilized, and the bond market’s 10-year expectation of inflation is back around 2.5%, consistent with the inflationary expectations from 2004-2007.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply