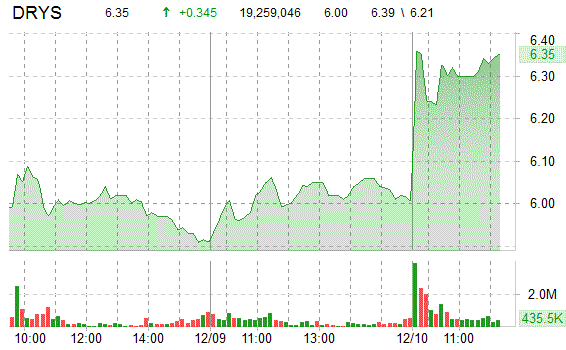

DryShips Inc. (DRYS) shares jumped 6% to $6.39, the highest intraday pps since April 20, on heavy volume in early morning trading Friday. The drybulk shipper’s stock was raised to “outperform” from “neutral” at Credit Suisse Group. The equity research firm also lifted its price target on DryShips by $4 to $9.

Volume on the name has exploded. Nearly 20 million shares were in play less than 90 minutes into the session compared to a daily average volume of 16.7 million.

Technically speaking, the shares of DRYS are down 0.83% on a y/y basis. The security has been moving largely higher over the past 5 -6 months, but looks to have found some support at $4.00. After displaying a narrow range intraday along the mid $4.50 – $4.75 area, the ticker was able to consolidate in mid October above its 50-day and 200-day MA — currently located at $4.93 ; $4.98 area (respectively) — prompting DRYS’ next leg up close to the current mid-$6 area. As DRYS continues its upward momo, a capitulation by the bears (15 million shares short, or 6.30% of float) could send the shares rallying even higher.

Over the past 12 months DryShips Inc. shares have traded between $3.28 and its 52-week high of $6.95. DryShips Inc. shares are now trading with a P/E Ratio of 0.62 and a trailing-12 EPS of 0.21.

At last check [12:17 p.m. EST], DRYS shares were up 34 cents, or 5.75%, to $6.35 in trading on the Nasdaq.

Disclosure: No Position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply