The Trade Deficit fell in October to $38.71 billion from $46.60 billion in September. The fall in the trade deficit is very good news for the economy. The trade deficit was also smaller than the $44.5 billion consensus expectation.

On a year-over-year basis, the total trade deficit was up 19.8% from $32.30 billion a year ago. The trade balance has two major parts: trade in goods and trade in services. America’s problem is always on the goods side; we actually routinely have a small surplus in services.

Relative to September, the goods deficit fell to $51.42 billion from $57.09 billion. That is a month-to-month decline of 9.9%. Relative to a year ago, the goods deficit was up 16.9% from $43.98 billion. The Service surplus was down slightly (1.8%) from September at $12.70 billion, and up 8.8% from last year’s $11.67 billion. Exports of goods increased by 4.2% for the month to $112.31 billion. Relative to a year ago, goods exports are up 17.9%.

On Target to Double Exports

In other words, we are easily on pace to meet President Obama’s goal of doubling exports of goods over the next five years. Service exports, on the other hand, were up just 0.9% for the month, but were up 8.3% year over year, which is well short of the pace needed to double over five years.

Doubling exports over five years is all well and good, but not if we also double our imports over the same time frame. After all, it is net exports which are important to GDP growth, as well as to employment. The monthly numbers were somewhat encouraging in this regard, as goods imports fell by $1.15 billion, or 0.7%, to $163.73 billion.

Relative to a year ago, goods imports are up $24.54 billion or 17.6%. At that pace, they would be up 124.9% over five years, while goods exports would be up just 127.8%. Given that imports are starting from a higher base that would mean an actual increase in the size of the trade deficit.

Put another way, in October we bought from abroad $1.46 worth of stuff for every dollar of stuff we sold. That was a bit of an improvement from the $1.53 worth of stuff in August, and equal to a year ago. On the service side, both imports (up 0.63%) and exports (up 0.93%) were up slightly from September. Relative to a year ago, service exports are up 8.3% while service imports are up 8.0%.

On a year-to-date basis for the first ten months of the year, the total trade deficit is up an astounding 39.1% to $420.64 billion, with the goods deficit up 32.3%, some what offset by the service sector surplus rising 13.4%. Then again, trade in goods simply swamps trade in services.

What We’d Like to See from Trade

All things being equal, it is better to see trade going up than down. We want to see both exports and imports growing, but given the massive deficit we are running, we need to have exports rise dramatically faster than imports, or actually see imports fall.

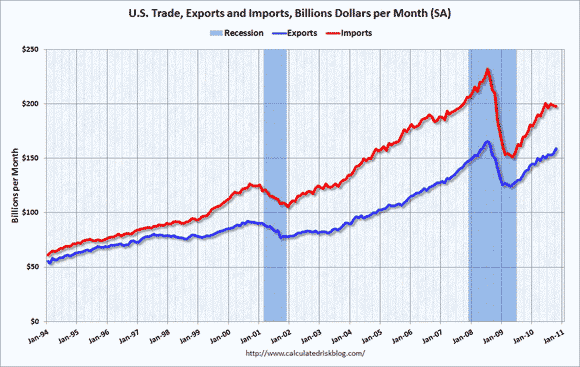

A big part of what made the Great Recession into a global downturn was an absolute collapse in global trade. This can clearly bee seen in the long-term graph of our imports and exports below (from http://www.calculatedriskblog.com).

Falling imports and exports are clearly associated with recessions. In the Great Recession our imports collapsed faster than our exports, and so we had a very big improvement in the trade deficit.

That was just about the only thing keeping the economy on life support during those dark days. For example, in the first quarter of 2009 the smaller trade deficit increased growth by 2.64%. If not for that, the economy would have shrunk by 9.0% instead of by 6.4%.

Thus, growing world trade is a good thing, but not if it comes at the expense of an ever-rising U.S. trade deficit. On the other hand, had it not been for a dramatic deterioration in the trade deficit, in the second quarter of this year GDP growth would have been over 5%, not 1.7%. In the third quarter it would have been 4.26% rather than 2.5%.

The better than expected trade numbers for October are a good omen for fourth quarter GDP growth. The sort of growth the economy is generating if the trade deficit is excluded is robust enough to start to produce significant numbers of jobs. Of course, though, you can’t just ignore the trade deficit.

Trade Deficit a Bigger Problem than Budget Deficit

The trade deficit is a far more serious economic problem, particularly in the short to medium term, than is the budget deficit. In the third quarter, the increase in the trade deficit subtracted a 1.76 points from the economic growth rate. If we had somehow managed to keep the trade deficit at the same level as in the second quarter, then second quarter growth would have been 4.26%, not 2.5%.

The trade deficit is directly responsible for the increase in the country’s indebtedness to the rest of the world, not the budget deficit. That is not just a matter of opinion, that is an accounting identity.

Think about it this way: during WWII the federal government ran budget deficits that were FAR larger as a percentage of GDP than we are running today, but we emerged from the war the biggest net creditor to the rest of the world that the world had ever seen up to that point.

Back then the federal government owed a lot of money, but it owed it to U.S. citizens, not to foreign governments. Now, however, slowly but surely, the trade deficit is bankrupting the country.

While most of the foreign debt is in T-notes, try think of it as if we were selling off companies instead of T-notes. This month’s trade deficit is the equivalent of the country selling off Dow Chemical (DOW), while last month’s deficit was the equivalent of selling off DuPont (DD).

How long would it take before every major company in the U.S. was in foreign hands if this keeps up indefinitely? Put another way, if the year-to-date trade deficit has totaled $420.6 billion, which is 77% as all the firms in the S&P 500 earned, worldwide, in 2009.

The Breakdown in Goods Deficit

The goods deficit has two major parts — that which is due to our oil addiction and that which is due to all the stuff that line the shelves of Wal-Mart (WMT). Of the total goods deficit of $51.42 billion, $19.14 billion, or 37.2% is due to our oil addition.

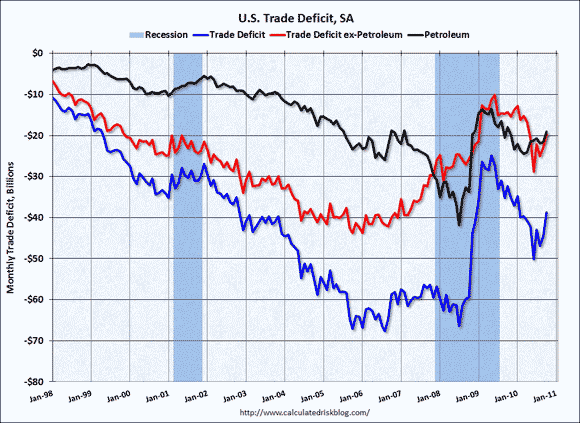

On a year-to-date basis, we have run a $220.7 billion deficit just from petroleum. The second graph (also from http://www.calculatedriskblog.com) breaks down the deficit into its oil and non-oil parts over time. It shows that the overall trade deficit (blue line) deteriorated sharply from 1998 to mid 2005 and then remained at just plain awful levels until the financial meltdown caused world trade to come to a screeching halt. That caused a major but unfortunately short-lived improvement in the overall deficit.

However, the stabilization in the non-oil deficit started about two years earlier, but that was offset by the effects of soaring oil prices which caused the oil side of the deficit to deteriorate sharply.

The monthly improvement in the goods deficit came from both the oil side and the non-oil side. On the non-oil side, the deficit fell to $31.01 billion from $34.09 billion, but still well above the $25.21 billion level of a year ago. That is a deterioration of $5.80 billion or 23.0%.

The oil deficit fell by $2.56 billion on the month, from $21.70 billion to $19.14 billion — a 11.8% improvement. Relative to a year ago, oil side of the deficit rose by 6.3%. For the first ten months of the year, the non-oil deficit is up by $65.57 billion or 26.6%, while the oil side is up by $59.48 billion or 36.9%.

The oil side should be the low-hanging fruit to bring down the overall trade deficit and thus help spur economic growth. Oil is primarily used as a transportation fuel. The technology exists and is widely used abroad to use natural gas to power cars and trucks. Thanks to the emerging shale plays, we have ample domestic supplies of natural gas, and on a per BTU basis, natural gas is selling for the equivalent of oil at $26.16 per barrel.

Breaking the Addiction to Oil

We need to get past the “chicken and the egg” problem of nobody wanting to buy a natural gas-powered vehicle because there are no convenient places to refuel, and gas stations reluctance to install refueling stations for natural gas powered vehicles since there are not many of them on the road. Not only would such a move save money for drivers in the long run (there is an upfront capital cost as natural gas powered engines are more expensive than regular gasoline powered engines), but it would substantially reduce our trade deficit.

Since it is a domestically produced fuel (and most of what we do import, we import from Canada) there is also a huge national security argument for moving to using more natural gas. The dollars we send abroad to pay for oil imports are simply the tip of the iceberg when it comes to the overall cost of oil. A substantial portion of the Pentagon budget is devoted to keeping the oil flowing in the Middle East and the sea routes open.

Natural gas is also a much cleaner fuel and emits far less CO2 than does gasoline. Thus it would be a very useful step towards stopping global warming. Doing this, especially breaking the “chicken and the egg problem” will take federal government leadership. The benefits for the economy, however, would be huge.

It seems inevitable to me that it will eventually happen, and when it does, it will be a great boon to major natural gas producers like Chesapeake (CHK) and EnCana (ECA). The timing of it happening is very uncertain, but the sooner it happens, the better.

I don’t want to minimize the cost of doing this, particularly in terms of water quality. We need to do more research on the chemicals used in fracking operations to get at the shale gas (starting with getting rid of the “trade secrets” provision that allows the firms to hide exactly what they are putting into the ground and potentially the groundwater). Still, it strikes me as a trade-off worth making.

Falling Dollar a Help, Not a Hindrance

The best thing that could happen to help on the non-oil side of the trade deficit would be for the dollar to fall. The strong dollar not only makes imports cheaper, it makes our exports more attractive. The recent decline in the dollar clearly has only started affected the overall trade deficit, but there is often a lag between currency movements and changes in trade patterns.

While I would not want to jinx it, there has been a remarkable improvement in the overall trade deficit since June when the goods deficit hit $62.2 billion, and most of that improvement has come on the non-oil side. The dollar has also fallen during that period, and I don’t think it is a coincidence.

It is not just a direct effect of say our being able to sell more goods in Japan because the dollar is weak relative to the yen, but U.S. companies are often in direct competition with Japanese or European companies in selling to third countries. For example, both General Electric (GE) and Siemens (SI) make MRI machines for hospitals. Assuming that they were of roughly equal quality, then when the Euro rises sharply against the dollar, GE is going to be able to undercut Siemens for export orders to China.

A Glance at Breakdown by Region

We ran some small trade surpluses with Hong Kong, Singapore and Australia, but we continue to run large deficits with most of our other trading partners. The biggest deficit by far is with China, the source of many of the goods on the shelves of Wal-Mart. It fell this month, to $25.5 billion from $27.8 billion. That is still 65.9% of our overall trade deficit.

While China has agreed to let the Yuan appreciate, so far it has done so at only a glacial pace. Our deficit with the European Union rose this month falling to $7.1 billion from $6.1 billion.

We also saw a decrease in our bilateral trade deficits with OPEC ($5.7 billion vs. $8.9 billion). Our trade deficit with Mexico was unchanged at $5.8 billion, while the deficit with Canada (by far our largest trading partner) edged up to $1.1 billion from $0.9 billion. The deficit with. Japan rose to $5.7 from $5.0 billion.

In Summation: Very Positive

Overall, this was a very positive report. It raises some hopes that the trade deficit could be a source of economic growth in the third quarter. It is the change in the trade deficit that drives GDP growth, not the level. As long as the trade deficit shrinks, it will add to overall growth, even if the level is still awful.

Getting the trade deficit under control has to be one of the top economic priorities. If we do, economic growth will be much higher, and we might actually start to see some significant job creation. With the rise in employment will come higher tax revenues which will help bring the budget deficit under control. To do that we need to do two things — first get our oil addiction under control. The second is that “King Dollar” is a tyrant and needs to meet the same fate as Charles I and Louis XVIII: Off with his head!

The Fed seems to understand this, and a weaker dollar is one of the more important mechanisms through which quantitative easing will tend to stimulate the real economy (and is the key reason why we are getting so much criticism about it from the rest of the world, as a decrease in our trade deficit would mean a corresponding decrease in they trade surpluses).

The U.S. can simply no longer afford to be the importer of last resort for the rest of the world. As worldwide trade deficits and surpluses have to sum to zero (barring the opening of major trade routes to Alpha Centauri) a reduction in the U.S. trade deficit has to mean that the trade surpluses of other countries has to fall (or other deficit countries have to run even bigger deficits).

Right now every country in the world is trying to maximize exports and minimize imports. We have to fight that battle as well, but it is a fight where we have been getting out butts kicked for decades now. Continuing to lose the fight could result in near fatal damage to our economy and way of life. As I have said before, the trade deficit is a far bigger economic problem than the budget deficit.

The downside of a weaker dollar is that it will tend to push up inflation. However, at this point, deflation is a bigger threat than runaway inflation (although with QE2, the risk of deflation is substantially reduced).

DOW CHEMICAL (DOW): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

Leave a Reply