Delinquencies on mortgages that underlie commercial mortgage-backed securities [CMBS] increased by another $1.63 billion in May, fueled in part by the bankruptcy of General Growth Properties Inc. (GGWPQ.PK), according to a report released this week by credit-rating agency Realpoint.

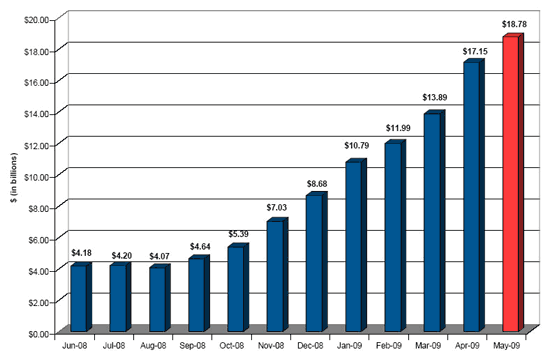

The amount of unpaid balance for CMBS increased for the ninth straight month to a new 12-month trailing high of $18.78 billion, reflecting once again the weakening of U.S. CRE and inability of borrowers to refinance maturing loans, the rating agency said. CMBS delinquencies are up over 368% from one-year ago.

Loans in special servicing (these are loans in imminent default-status, and are typically transferred from a master to a special servicer) increased in May by an unprecedented $12.53 billion to a trailing 12-month high of $37.05 billion.

According to Realpoint’s analysis, the delinquency of unpaid CMBS balance will continue along its current trend and grow between $20 billion to $30 billion by mid year 2009, with the potential to hit $40 billion before the end of 2009 under heavily stressed scenarios.

Over the past 2q’s, delinquency growth by unpaid balance has averaged roughly $1.96 billion per month, Realpoint said.

Graph: Real Point

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply