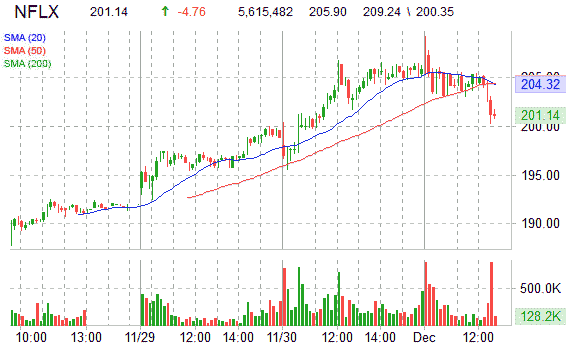

With the markets soaring on Wednesday, there are very few stocks that are having a red performance. One of them is Netflix, Inc. (NFLX), which continues to remain weak as it struggles with the $205.00 level, bringing the $200.00 level in play. Currently, L2s are seeing some drop and pop type plays, but with not much forceful follow through.

Technically speaking, NFLX has been a solid gainer lately, outpacing the broader SPX by 253% during the past 52 weeks. However, since rallying to a new high of $206.80 last week, the equity has taken a breather from its quest for new highs, and is now trying to establish a short-term base in the $200 area. Having said that, there isn’t strong support in this vicinity, which suggests the stock could be on its way lower over the near-term if the bears can sustain the shorting. On the other hand, a capitulation by the bears could send the shares rallying higher from current levels.

NFLX currently trades at a trailing P/E of 76.10, a forward multiple of 52.79 and a P/E to growth t/12 ratio of 2.50. More than 6.7 million shares (as of 1:21 p.m. EST) have already traded hands compared to a daily average of around 5.5 million.

With less than 3 hrs left in pit trade, NFLX has dropped $5.57 to $200.36.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply