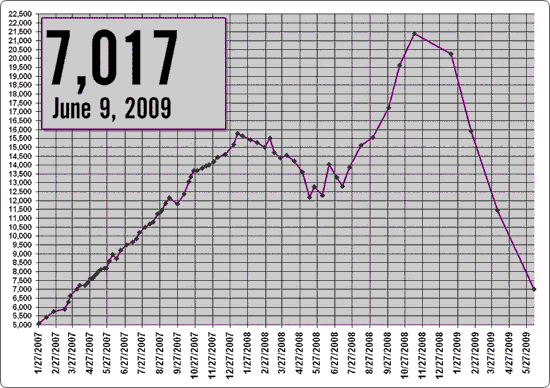

The Countrywide Foreclosure Blog reports that there are currently 7,017 foreclosed homes being offered for sale on the Bank of America/Countrywide website, down from the peak of 21,500 last November, and back to levels of April 2007 (see chart above).

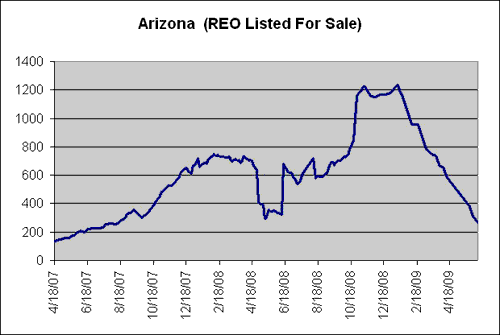

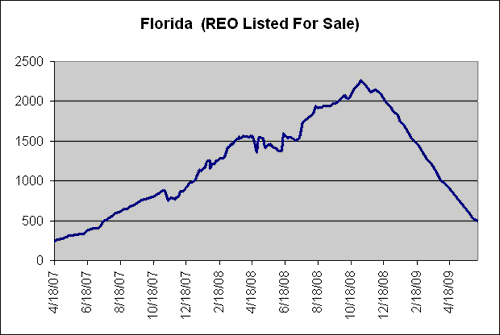

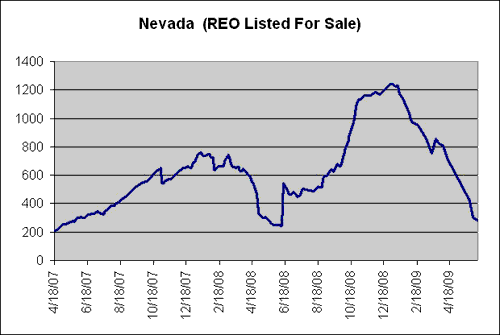

Below are charts for the individual states that had some of the worst foreclosure problems (CA, AZ, FL and NV), showing significantly reduced levels of lender-owned (REO) properties in June 2009. In all cases except Nevada, the REO levels are at two-year lows and Nevada foreclosures are close to a two-year low.

Comment: This is just one company – although Countrywide was (or still is) the largest mortgage company in the U.S. and financed 20% of home mortgages in 2006 – but doesn’t this suggest that the real estate markets are slowly healing and recovering, and gradually returning to normal as the foreclosed properties are sold?

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

I’m not so sure about this; some states now have moratoriums (moratorii?) on new foreclosures; California just began its own attempt in this regard recently. I believe that part of the reason for the reduced rate of foreclosures may be that the banks are being forced to manage their foreclosures so they don’t all come to market at once–the states may force this or the investors may require it, but the point is that there are still many properties to come on the market which are now, or will be, owned by the lenders.

Steve B.