In recent speeches, Ben Bernanke has referred to a(n) (implicit) target of around 2% for inflation in the US. The U.S. Federal Reserve, together with the Bank of Japan, is one of the few central banks in advanced economies without an explicit inflation target.

Bernanke’s reference to this number is in the context of concerns that QE2 (second round of quantitative easing) will increase inflation in the US and with this message he wants to reassure the public that inflation will remain low. The exact words that he is using are:

“FOMC participants generally judge the mandate-consistent inflation rate to be about 2 percent or a bit below.”

It is interesting that the expression “2 percent or a bit below” happens to be almost identical to the way the ECB currently refers to its mandate for price stability.

Some history about the ECB mandate: Originally, the ECB was given the mandate of maintaining “price stability”. This mandate was later (October 1998) made precise by the governing council of the ECB as “a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%”. At that point there was also a reference to this target, or to price stability more generally, a a mandate “to be maintained over the medium term”.

This initial definition of price stability by the ECB received some criticism because it was leaving too much room for interpretation: Is any inflation rate below 2% consistent with price stability? Is deflation consistent with price stability or even desirable? This led to a redefinition of “price stability” by the governing council of the ECB in May 2003. At that point, the mandate of price stability was defined as “maintaining inflation rates below but close to 2% over the medium term”. So 2% becomes a ceiling (for the medium term) and the goal is to be close enough to the ceiling. Clearly, in this definition there is a sense of asymmetry: 2.1% inflation is worse than 1.9%.

The words chosen by Ben Bernanke are almost identical to the words chosen by the governing council of the ECB where “below but close” has been replaced by “or a bit below”.

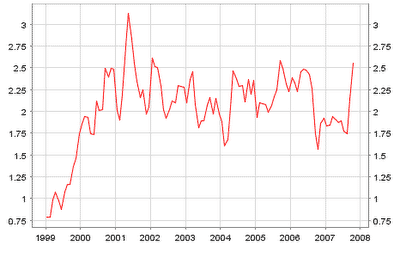

What is the record of the ECB? Clearly the ECB has managed to keep inflation very close to 2% and as such we could call it a success. However, given the definition of price stability, it seems that inflation has remained many more months above than below 2%. Below is a picture of Euro inflation from the launch of the ECB until the recession of 2007/2008. Inflation is close to 2% but it would be more accurate to describe it as “above but close to 2% than “below but close to 2%”. Or using Bernanke’s words “2% or a bit above”.

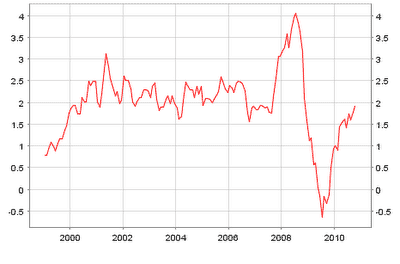

If we add the last two and a half years of data (picture below), towards the end of 2007 inflation increased substantially and then it fell during the recession, below the 2% target. Today, inflation is once again approaching the 2% target.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply