Netflix Inc. (NFLX) continues to squeeze higher this morning. The ticker climbed 8 percent to $186.79 (+$14.30) and rallied to $187.80 earlier, the highest intraday PPS since the company went public eight years ago. The mail-order and online movie-rental service said on Monday that it will offer its lowest subscription yet, a $7.99 deal for its streaming services. Netflix also announced a series of price increases to its monthly fees.

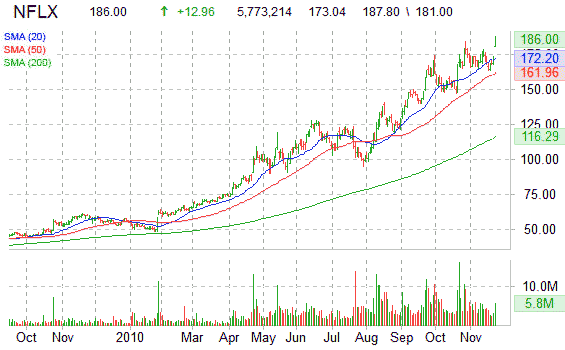

Technically speaking, the shares of NFLX are up more than 188% since the start of the year. The stock has been in a higher highs and higher lows type – pattern since hitting a 52-week low of $48.52 in Jan 25, 2010.

The equity, which has been moving largely higher over the past ten months, and currently trading above the 50-day and 200-day moving averages…$161.96, $116.29, respectively, is well above its mini-support located at $170 level, which has held the stock relatively in check since the beginning of this month. It is possible NFLX will pullback and retest its new found-support. In addition, the stock’s Relative Strength Index now rests at 67.48 – in relatively overbought terrain – indicating that a pullback may be in the cards. Having said that however, we could also see in the next few sessions the participation of higher timeframe traders who could extend the ticker’s PPS higher.

Netflix currently trades at a trailing P/E of 70.36, a forward multiple of 49.06 and a P/E to growth ratio of 2.11. More than 5.7 million NFLX shares have already traded hands compared to a daily average of around 5.2 million.

NFLX, whose market cap prints at $9.73 billion, gained $13.10, or 7.59 percent, to $186.00 at 12:51 a.m. EST in Nasdaq composite trading.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply