The U.S. Dept. of the Treasury released on Monday the TIC (Treasury International Capital) data for April 2009.

From the Treasury: Net foreign purchases of long-term securities were $11.2 billion.

Net foreign purchases of long-term U.S. securities were $34.3 billion. Of this, net purchases by private foreign investors were $18.3 billion, and net purchases by foreign official institutions were $16.0 billion.

U.S. residents purchased a net $23.0 billion of long-term foreign securities.

Net foreign acquisition of long-term securities, taking into account adjustments, is estimated to have been negative $8.8 billion.Foreign holdings of dollar-denominated short-term U.S. securities, including Treasury bills, and other custody liabilities decreased $39.4 billion. Foreign holdings of Treasury bills decreased $44.5 billion.

Banks’ own net dollar-denominated liabilities to foreign residents decreased $5.0 billion.

Monthly net TIC flows were negative $53.2 billion. Of this, net foreign private flows were negative $58.4 billion, and net foreign official flows were $5.2 billion.

According to CFR’s Brad Setser, this is a very weak report based on the fact that the demand for U.S. financial assets from the rest of the world in April was “very modest.” Mr. Setser, among other points, makes a quick note about China’s T-holdings.

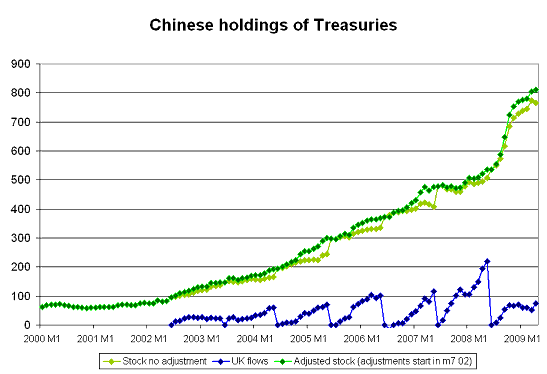

From CFR: After adjusting for China’s purchases through the UK, I would guess that China’s total Treasury portfolio inched up in April. Consider the following graph, which shows the UK’s long-term holdings, China’s recorded Treasury holdings, and the Setser/ Pandey estimate for China’s true Treasury holdings.

But the rise in China’s Treasury holdings — even after the adjustments — was modest. And China isn’t buying Agencies or US corporate bonds. China’s overall US portfolio isn’t rising at anywhere like the pace it did in 2006, 2007 or even 2008.

And ultimately that is a healthy adjustment. The more unwanted dollars China ends up holding, the bigger the ultimate risk of a disruptive shift out of the dollar.

Graph: CFR

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply