Seriously, a rate hike in this environment? Or anytime before the end of 2009? At the moment, I just can’t see it happening. That said, long rate are higher, and inflation expectations in some corners of the market are rising. What is going on? My explanation for recent market action revolves around three themes:

1. Financial Armageddon appears to have been avoided – at least for the moment. The “all but explicit” implicit guarantee that no significant US financial institution will be allowed to fail established a return to financial stability. And with that stability comes an end to the flight to safety that buoyed Treasury prices. Something off a conundrum for Treasury Secretary Timothy Geithner – cheap financing of the staggering US deficit appears to be dependent on financial instability.

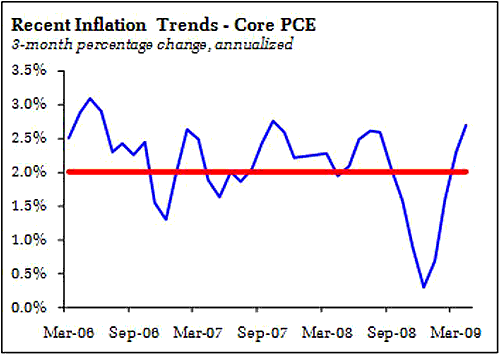

2. Recent inflation numbers are not exactly what I would call benign. The trend in core PCE is not deflationary:

I think deflation fears were always overblown – the current batch of monetary policymakers are simply dead set against such an outcome. The deflation trade, like the flight to safety, needed to be priced out of Treasury’s and TIPS. The outcome: Breakeven spreads are up sharply.

3. The US, in aggregate, is borrowing less from the world than a year ago. But make no mistake, we still rely on capital inflows to maintain a substantial US current account deficit. Lacking a flight to safety, it is not clear that private investors are willing to support that deficit at 2.75%. Or even 4%, for that matter. That fact that foreign central banks are accumulating Dollars is proof positive that private investors don’t want to do the job – and the transition in central bank purchases from the long end to the short end suggest that even they grow weary of this game. Remember, the argument that “Japan ran a massive budget deficit so we can too” falls apart when you recognize that for decades Japan has been able to rely entirely on internal savings to finance the deficit. My interpretation: The invisible hand (apologies to Gavin Kenndey) is still pushing for lower US consumption to bring the external accounts into better balance – and that means higher rates to maintain inflows while suppressing the pace of economic growth. I understand this is in direct conflict with the output gap story; reconciling the two, I believe, requires an admission that the US economy is terribly structurally imbalanced internally. We may have excess capacity, but not excess capacity to make anything anybody real wants.

Where do Federal Reserve policymakers stand on recent dynamics? Turning to Federal Reserve Chairman Ben Bernanke:

In markets for longer-term credit, bond issuance by nonfinancial firms has been relatively strong recently, and spreads between Treasury yields and rates paid by corporate borrowers have narrowed some, though they remain wide. Mortgage rates and spreads have also been reduced by the Federal Reserve’s program of purchasing agency debt and agency mortgage-backed securities. However, in recent weeks, yields on longer-term Treasury securities and fixed-rate mortgages have risen. These increases appear to reflect concerns about large federal deficits but also other causes, including greater optimism about the economic outlook, a reversal of flight-to-quality flows, and technical factors related to the hedging of mortgage holdings.

Not terribly different from my interpretation. The greater optimism and safety reversal is effectively the same as the end of the Armageddon trade, and the federal deficit concern ties into aggregate US borrowing. The technical factors – referring to hedging against the increased expected duration of mortgage assets as mortgage rates rise – appears to me to be related to a general increase in rate pressures as a whole, but I will defer to fixed income specialists on that topic. He does not identify the change in central bank purchasing patterns, but neither does he mention the Fed’s decision at the last FOMC meeting not to expand their Treasury purchase program.

Note that he also does not mention inflation concerns, which some believe is the true reason for recent market action. On inflation, Bernanke covers familiar territory:

Even after a recovery gets under way, the rate of growth of real economic activity is likely to remain below its longer-run potential for a while, implying that the current slack in resource utilization will increase further. We expect that the recovery will only gradually gain momentum and that economic slack will diminish slowly. In particular, businesses are likely to be cautious about hiring, and the unemployment rate is likely to rise for a time, even after economic growth resumes.

In this environment, we anticipate that inflation will remain low. The slack in resource utilization remains sizable, and, notwithstanding recent increases in the prices of oil and other commodities, cost pressures generally remain subdued. As a consequence, inflation is likely to move down some over the next year relative to its pace in 2008. That said, improving economic conditions and stable inflation expectations should limit further declines in inflation.

He is sticking to the output gap argument to dismiss inflationary concerns. Those expecting hyperinflation dismiss this Bernanke’s position, arguing that emerging markets often experience weak growth combined with high inflation. I believe this line of reasoning ignores the institutional differences that prevent price inflation from being propagated via wage inflation in the US. We simply lack the populist/union dynamic that makes such a dynamic possible. Can such a dynamic develop? Sure, over time, with sufficient policy errors. But in time to prompt a rate hike in 2009? Doubtful. Very, very doubtful.

(As an aside, the rise in unit labor costs reported by the BLS will not be interpreted by Fed policymakers as evidence that wage inflation is accelerating . Note how unit labor costs are constructed – a drop in output, as one typically sees during a recession, if not matched by an equal drop in hours worked, is almost certain to generate a jump in labor costs. But this is not a signal that labor costs are rising rapidly; it signals that firms are not bringing capacity in line with demand – they need to fire more workers, or cut their wages.)

Combine Bernanke with the Beige Book:

Reports from the twelve Federal Reserve District Banks indicate that economic conditions remained weak or deteriorated further during the period from mid-April through May. However, five of the Districts noted that the downward trend is showing signs of moderating. Further, contacts from several Districts said that their expectations have improved, though they do not see a substantial increase in economic activity through the end of the year.

No significant growth implies a widening output gap and higher unemployment rates, which means no rate hike on the horizon. Even more important, with no mechanism to link price inflation to wage inflation, the Fed will not respond to high core inflation (above) and certainly not rising headline inflation, instead viewing the higher prices as a deflationary force via the erosion of real incomes. Which, interestingly, fits with my hypothesis that the invisible hand is attempting to suppress US demand growth. This suggests that neither of the deflation/inflation extremes will be correct; most likely correct is a slightly elevated inflation rate combined with low wage growth. Not pretty, but not a disaster. That is, of course, assuming policymakers will accept such an outcome. The most significant risk, in my opinion, is that the Fed has lost monetary independence. Not there yet.

To be sure, market participants will react to the occasional loose cannon from the hinterlands of US central banking, district bank presidents. The most direct has been Kansas City Fed President Thomas Hoenig, but Richmond Fed President Jeffrey Lacker often gets the more prominent headlines:

In his speech to North Carolina’s lawmakers, Lacker stressed the importance of not waiting too long before raising interest rates in case this allowed inflation to take root.

How long is too long? Even Lacker does not sound itching to raise rates this year:

But he emphasized during his discussion with reporters that he still expected the very weak state of the economy to warrant low Fed rates for a while.

“I think growth is likely to warrant rates as low as they are for some time, but just how long is uncertain and hard to predict in advance. We’ll just have to wait to see how the growth process unfolds this year and into next year,” he said.

Note his timeline, “into next year.” Even the hawkish are not really hawkish.

Bottom Line: Looking for a rate hike this year is premature. Too much slack in the US economy will keep the Fed on the sidelines. If you are arguing for an incipient inflation outbreak that requires a policy response, you need a story explaining how price pressures are translating into wage pressures. Right now, I don’t see that story. Maybe after another decade like this, but not right now.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply