Shares of BlackRock Inc. (BLK), the world’s largest asset-management firm, fell more than 5 percent in electronic trading after Bank of America Corp. (BAC) and PNC Financial Services Group (PNC), two of BlackRock’s biggest shareholders, said they plan to sell 42 million shares of the co.’s common stock.

BofA is offering at least 34.5 million shares it holds in BlackRock Inc., reducing its stake in the money-manager to as little as 12.6% from 33.9% previously, while fellow part-owner PNC Financial Services Group is selling up to 7.5 million shares. The offering is expected to price next week.

“BlackRock will not receive any of the proceeds from the sale of shares of its common stock,” the investment firm said in a statement. “The sale of shares of common stock to be sold includes shares of common stock issuable upon conversion of BlackRock’s Series B Preferred Stock.

Bank of America spokesman Jerry Dubrowski said selling the stake was consistent with the bank’s “strategy to narrow the focus of our franchise and ensure that every activity we have at Bank of America is core to our three customer groups: consumers, companies and institutional investors.”

Bank of America also said it expects to grant the underwriters — BofA Merrill Lynch and Morgan Stanley (MS) — a 30-day option to purchase an additional 6.3 million shares of BlackRock’s common stock to cover over-allotments, if any.

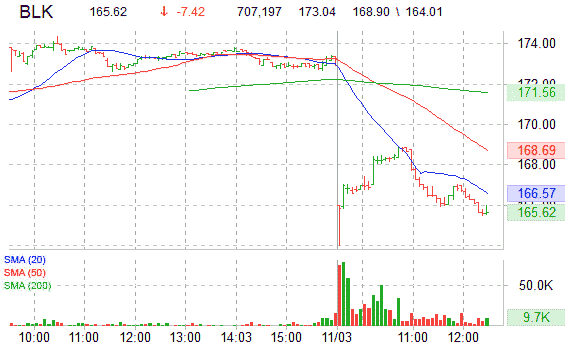

Share action: BLK down $7.42, or 4.27 percent, to $165.62 in mid-day trading Wednesday.

Shares of Bank of America and PNC are marginally up.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply