Bailed-out insurer American International Group (AIG) said Monday it raised nearly $37 billion from the initial public offering of its Asian life business AIA and the sale of its global life unit Alico, and will use that money to repay a government bailout.

AIG closed the sale of Alico to MetLife (MET) for $16.2 billion on Monday. The sale includes $7.2 billion in cash and $9 billion in MetLife securities. Earlier in the month, New York-based AIG also raised $20.5 billion by offering AIA Group on the Hong Kong Stock Exchange.

“These transactions will generate sufficient cash to allow AIG to pay off the FRBNY (Federal Reserve Bank of New York) credit facility, marking a major milestone in our commitment to repay the American taxpayers,” AIG CEO Robert Benmosche said in a statement.

The new capital is aimed at accelerating AIG’s payback of bailouts it received from the government during the financial crisis, currently totaling $182.3 billion.

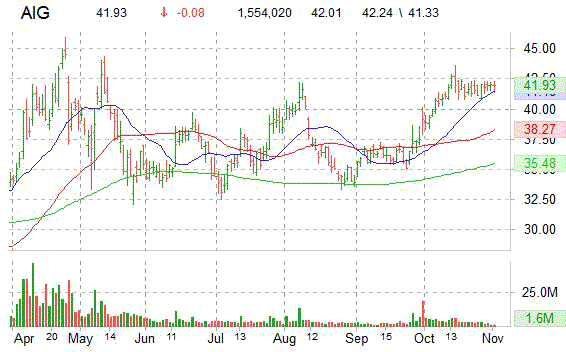

Shares of AIG fell $0.11, or 0.27 percent, to $41.90 in morning trading on Monday.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply