Shares of Amazon.com Inc. (AMZN) rose as high as $166.13 earlier in the session, the highest intraday pps since the co. went public in May 1997. The Web retailer was raised to “Buy” from “Neutral” this morning at Bank of America Corp. (BAC) ahead of the co.’s September quarter results, which are due after the bell.

BofA said it raised Amazon’s price estimate to $190 from $176, noting that both Google‘s (GOOG) and eBay‘s (EBAY) strong results suggested further positives for Amazon shares. eBay, a co. with more than $9 billion in revs this year, had 2% sequential growth in gross merchandise value in Q3, while Google, whose trailing 12 prints the co.’s revs at nearly $28 Billion, had 8% sequential growth in Q3. According to BofA, if the same pattern follows with Amazon, and they have the same 17% sequential growth in Q3 that they had in 2009, the company would have $7.7 billion in revenue, which is $300 million above the Street $7.4 billion consensus.

BofA also said it anticipates a “significant” uptick in sales of the Kindle eBook reader. The firm believes the $74 billion market cap company could sell more than 3 million of the e-book readers in Q4.

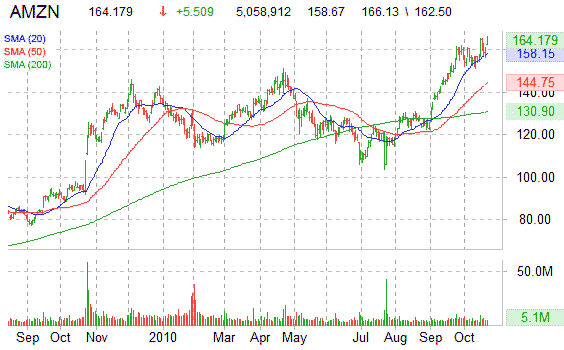

Technically speaking, AMZN shares have outpaced the broader SPX by an impressive 61.85% during the past year. Since bouncing off its $155 support level in mid October, the stock has surged higher on good breakout trading volume with price currently nearing a test of the $175 area.

Amazon.com is currently trading approx. 13.9% above its 50-day moving average of $144.76 and 26% above its 200-day MA of $130.91. In the last five trading sessions, both the 50-day and the 200-day MA have climbed steadily, confirming the company’s upward momentum.

At last check, AMZN shares were up $5.65 to $164.32, a gain of 3.56%. The 52-wkh for AMZN, prior to today’s new print, was $165.19 on the 18th of October 2010. The lowest 52-wk price was $91.70 on the 22nd of October 2009.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply