Futures are up overnight and spiked higher on the release of the monthly employment situation for May. The headline monthly number plunged to 345,000 yet the headline unemployment rate jumped to 9.4%.

Prices are approaching the 961 pivot point with the short term stochastics overbought. It would appear that wave C up of B is well underway. The bugaboo in all this, of course, is the bond market which is again launching rates higher with long bond futures hitting yet another new low as the parabolic collapse of longer term bonds continues.

That’s the tradeoff, money flowing into equities pulls capital from bonds and hence higher interest rates. Of course that will pressure all holders of debt, especially the middle class who are riddled with it. It will certainly slow down the housing industry and will eventually stress governments as they too carry and must finance their massive debts.

Here’s a link to the BLS’s employment report: BLS Employment Situation Summary.

Interesting that the numbers for March and April were revised downward: “The change in total nonfarm employment for March was revised from -699,000 to -652,000, and the change for April was revised from -539,000 to -504,000.”

At first glance it appears to me that with their numbers falling but the rate rising that the numbers of people being laid off has reached a plateau, but that people are now falling off the roles on the other end as their benefits run out. Also jobs are not being created and that’s why the RATE continues to rise dramatically.

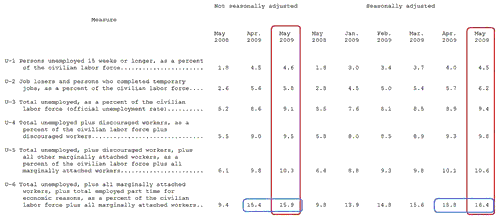

When we look at the alternative measurements from the BLS and we find that the numbers are rising across the board! Here’s the link to the BLS Alternative Measurements, and the table is reproduced with my highlighting below (click on chart to enlarge):

Here we find U6 (the measurement most closely resembling how employment has been calculated in the past) ROSE from 15.8% in April to 16.4% in MAY, while the Raw data rose from 15.4% to 15.9%!!

I’m not convinced that the sudden drop in the headline number is copasetic, I’ll have to do some more research. Frankly, I just don’t trust the BLS and their numbers, and the reporting of government statistics is critical to maintain confidence. The numbers need to calculated consistently over time and they need to be transparent. We’ll have to wait and see if the decrease in the headline number can be sustained over time. There’s more unemployment in the pipeline.

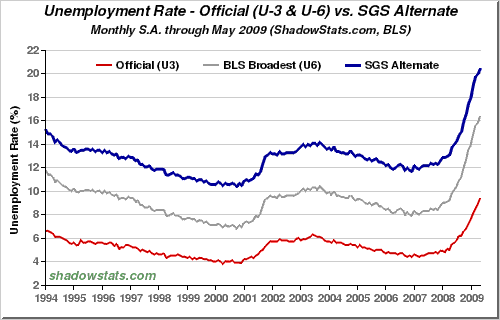

Here’s John William’s Unemployment chart with his alternative measures that more closely resemble the U6 numbers:

Chart: Shadow Government Statistics

Okay, 9.4% is their official number now. Seasonally adjusted U6 is at 16.4%. Now we’ll have to see what happens as we transition out of spring and into the next phase of the auto crisis with factories closing and dealerships being shuttered. Also, the next phase of the housing crisis is right around the corner as we are leaving the subprime debacle and entering the option arm resets on the higher end homes that should be in full force by the end of the year and we have rising interest rates just in time to greet those who must reset.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply