Wonder Auto Technology, Inc. (WATG) is using acquisitions to expand into airbag and seatbelt manufacturing in China. WATG is trading well-below its peers with a forward P/E of 11 compared to its peers at 18x.

Safety Is Where It’s At

On Sep 7, the company announced it had completed its acquisition of Jinheng BVI Limited, which made airbags and seatbelts. Jinheng has over 50% of China’s airbag market and is the largest national brand supplier of three-point pretension seatbelts in China.

This acquisition will compliment Wonder Auto’s other businesses which produce electrical parts, suspension products and engine accessories for the Chinese and overseas auto markets.

With Jinheng being such a large player in the safety category, Wonder Auto intends to cash in on its dominance, especially as the Chinese government starts mandating certain safety systems.

The company paid for the acquisition with cash on hand and bank loans. It expects it to be accretive to shareholders.

Wonder Auto also raised its fiscal 2010 sales revenue guidance by $300 million or higher. The company is expected to report results on Nov 1 so we’ll get more details then about how lucrative this acquisition will be for shareholders.

Analysts Like 2011 More Than 2010

In the last 90 days, the 2010 Zacks Consensus Estimate has risen by 11 cents to 86 cents. But it is really 2011 that is jumping for the analysts.

The 2011 Zacks Consensus has climbed to $1.35 from 98 cents in the last 3 months. Analysts now expect earnings growth of 57% in 2011 compared to just 5% in 2010.

Second Quarter Sales Jumped 37.9%

On Aug 9, Wonder Auto reported its second quarter results and saw sales increase in both its Chinese business and its business outside of China.

Within China, sales rose 41.1% to $60.9 million on higher sales volume due to demand in the automotive market. Outside of China, sales jumped 16.5% to $7.6 million compared to the year ago period.

Wonder Auto is a Value Stock

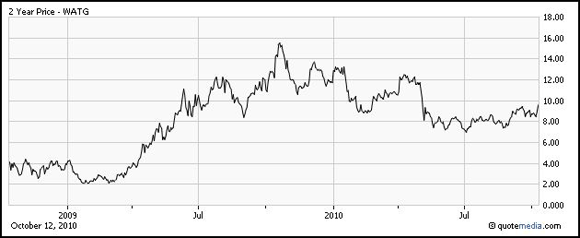

Many of the Chinese stocks have had a rough year, including Wonder Auto. Shares came off the March 2009 lows in a terrific rally but in 2010 have reversed course.

In addition to a low P/E ratio, it also trades with a price-to-book ratio of 1.5 which is well within the value parameters.

Analysts expect earnings to grow on average of 21% over the next 5 years, and with its low P/E this translates into a PEG ratio of just 0.5 which means it has the best of both worlds both growth and value.

Wonder Auto is also a Zacks #1 Rank (strong buy) stock.

Leave a Reply