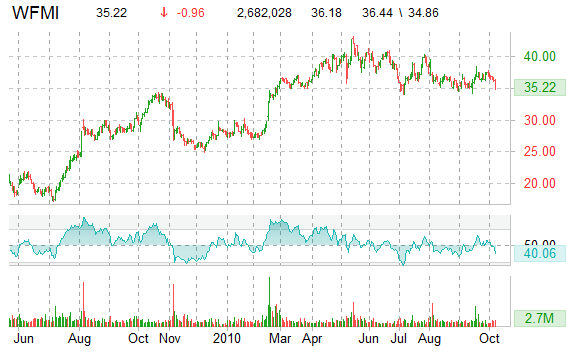

Shares of Whole Foods (WFMI) are down nearly 4 percent as we head into the second half the session. The stock is at a critical juncture on the charts – currently, WFMI, has violated its 50 and 200 day moving average measurements. The ticker was looking earlier to find support at $35.06 area, but that level was taken out as shares kept sliding. It seems that the recent drop in pps are both being driven more by investor emotion than a change in co.’s fundamentals. WFMI’s key ratios are as follows: profit and operating margin of the $6 bln market cap co. currently stand at 2.55% and 4.98%, respectively ; current ratio is at 1.55 ; quarterly revenue growth on a y/y basis prints at 15% ; $8.7 billion in trailing twelve revs ; ROA, ROE are at 7.14% ; 10.44%, respectively. But despite WFMI’s respectable fundamentals, investors, who have the greatest buying power to influence a stock’s price, seem to be growing frustrated with the securities’ tendency to slip further into the red, particularly after it broke both sma levels. WFMI may need to change trend-direction here before the bears start feeling the heat. Otherwise, shorters will keep piling up.

If ticker doesn’t hold the $35 level than capitulation dump could see $30s.

So far today, WFMI has hit a low of $34.94 and high of $36.44. The current trading volume of 1,3 mln is less than average volume of 2,4 mln shares. The ticker is trading below the 50 day and 200 day MA, $35.73 ; $36.46, respectively. The stock’s 52 week range is between $24.94 to $43.18.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply