Do recently rising oil prices signal a resurgence of economic growth?

In the WSJ Blog Environmental Capital, Russell Gold writes of

a growing belief that the economy could be regaining its footing and oil prices will climb to the price that OPEC is willing and able to defend…. “[T]here would be no reason why the current price rally could not extend to $75 within a fairly rapid timeframe,” [Paul] Horsnell wrote in his weekly overview of oil-market conditions. Believers in oil-market fundamentals are left scratching their heads. Exxon Mobil Corp. chairman and chief executive Rex Tillerson told reporters earlier this week that he couldn’t see any reasons involving supply and demand to push up oil prices. He attributed the recent oil rally to fluctuations in the U.S. dollar and people trying to get in front of a perceived economic recovery.

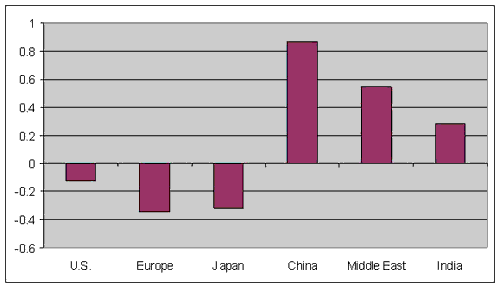

The first point I’d emphasize about this hypothesis is that the recovery people are talking about isn’t necessarily in the U.S., Europe, or Japan. Developments in those countries are not what have been driving the oil market in recent years. These regions reduced their consumption of oil by almost 800,000 barrels per day between 2005 and 2007, a time when the price of oil was booming. The increases in demand over that period came instead from places like China, India, and the Middle East.

Change in petroleum consumption (in million barrels per day) between 2005 and 2007. Data source: EIA.

And, as Dave Cohen notes, the additional drops in consumption from the major industrialized countries since the start of 2008 have been quite remarkable. U.S. oil consumption in the first three months of this year averaged 18.8 million barrels per day, almost 2 mb/d below the value for 2007:Q1. Japan’s real GDP fell at a 15% annual rate in the first quarter, and its overall oil product output for April was 14% below year-earlier values, though the April measure of Japan’s industrial production showed a sharp gain. GDP declines in Europe also exceed those in the United States.

So to the extent that oil speculators see any green shoots, perhaps they’re in the nature of Asian bamboo rather than American prairie grass. Chinese oil consumption was up 4% in April, though that was the first year-on-year gain for them in 6 months. India’s oil consumption also seems to be growing. But so far those gains are well below the drops seen in the U.S. and elsewhere.

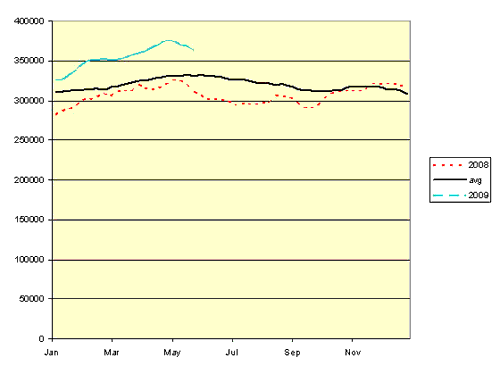

Whatever recent developments in Asia may mean for the future, there is a physical product being produced and consumed in the here and now at a price that Friday moved above $66/barrel. If that price is such that the current quantity produced exceeds the current quantity demanded, it would have to show up as an addition to storage, either as inventory build-up, or, as Dave Cohen emphasizes, held in tankers at sea. The graph below plots the behavior of U.S. crude oil inventories over a typical year, along with what actually happened in 2008 and so far in 2009. The fact that inventories were significantly below average in the first half of 2008 is one of the indicators to me that you can’t attribute the whole run-up at the time to speculation.

U.S. crude oil stocks, excluding SPR, in thousands of barrels. Bold line: average over 1990-2007. Red: 2008. Turquoise: 2009. Data source: EIA.

By contrast, so far this year inventories have been well above average. Futures prices had exceeded spot prices by enough until recently that there was a risk-free profit to be had from buying at spot, storing the product physically, and hedging by selling futures. Had it not been for the added demand for oil coming from inventory accumulation, the price would have fallen further. Nevertheless, it is interesting that U.S. inventories have been coming down significantly during May, the same month when oil prices started to rise significantly, although inventory levels remain above average. Here’s Dave Cohen’s conclusion:

Physical traders storing oil will start dumping it back on the market. They will need to dump it all or pile up losses leasing supertankers. The ensuing snowball will cause the oil price to crash. Oil may fall below its February low as today’s distorted $62 price becomes tomorrow’s distorted $25 price.

China’s demand may or may not be about to resume its spectacular growth, but if not now, in a few years surely. Anyone who sells oil now at $25 rather than wait a few years would in my opinion be throwing their money away.

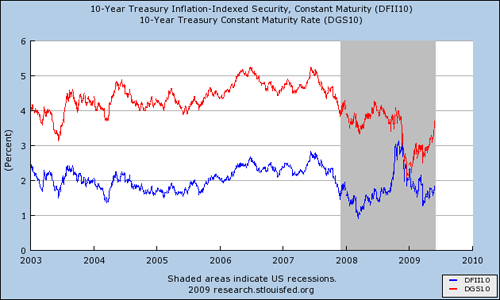

Then there’s that question of inflation. If you think that current U.S. budget deficits raise a significant risk of future inflation— and I do– a long position in commodities is one way you might want to hedge against that. Granted, oil’s price is rising in every currency, not just dollars, though the inflation risk is not by any stretch confined to the United States. It seems unlikely to be a coincidence that these moves in commodity prices coincided with a surge in long-term U.S. nominal yields, a surge that is not matched by TIPS, though the gap between the two (the implied expected inflation rate) is still smaller than I can explain.

Source: FRED.

Maybe prospects for near-term real growth, particularly in Asia, have improved. Maybe expectations of inflation have been creeping up. Or maybe, as Dave argues, speculators have gotten ahead of the reality of the first two. But oil stores for quite a while, particularly if you just leave it in the ground. Anyone with oil to sell should be looking not months but years ahead.

Perhaps those crazy speculators are doing just that.

Supply, demand, and the price of oil

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply