Europe’s overall economic tendencies, in terms of recovery efforts, remain currently very hesitant and highly vulnerable given the downturn in housing markets, high commodity prices and massive global imbalances.

According to Paris-based Organization for Economic Co-operation and Development [OECD] ; the European economy will slow at a faster pace than previously predicted.

In its brief overview of the near-term prospects in the major European economies ; OECD stated Tuesday that the economic activity in Europe will remain weak through the rest of fiscal ’08. OECD however, did not use the word recession to describe the situation.

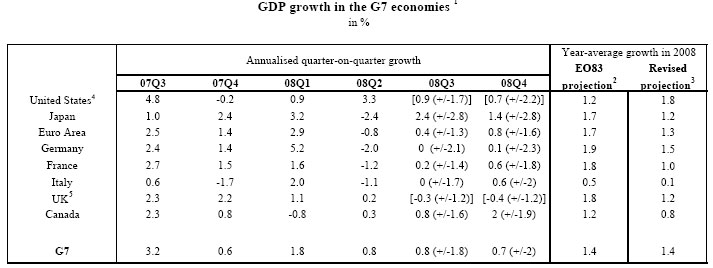

Based on incoming indicators the think-tank gave forecasts on the region’s four big economic powerhouses: Germany, France and Italy – suggesting they will barely post growth this year, while England is predicted to actually shrink by 0.075 and 0.1% in the third and fourth ’08 quarters respectively. The biggest drag on the British economy continues to be the housing market. Given the reduced credit supply and difficult market conditions, Prime Minister Gordon Brown announced a tax-suspension on residential home purchases costing less than 175.000 pounds, affecting almost half of all homes on the market in Britain. The Brown government is also assisting 16,000 people struggling to meet mortgage payments and another 10,000 to buy their first home.

In its statement, OECD raised its annual forecast for the U.S. economy from the one it had published in June, to 1.8% from 1.2%. The euro area had a revised year-average growth projection of 1.3% from 1.7%, followed by Japan’s revision of 1.2% from 1.7% and Canada’s 0.8% from 1.2%.

For the G7 leading industrialized nations as a whole, the annual growth forecast for fiscal ’08 remained unchanged at 1.4% from the projection the organization made in June ’07.

I think, the slowdown in growth of the past few quarters in Europe is due mainly to macroeconomic factors, as opposed to structural ones. The main elements of demand — consumption and investments, whether private or public, need to be given a substantial boost in order to offset Europe’s currently weak buying power. However, Europe despite the difficulties that it is presently facing – with a positive trade balance and increasing exports is certainly competitive. But, its stagnating internal demand is an issue that should be addressed, granted chances of it succeeding are certainly higher under a more favourable macroeconomic climate.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply