Mortgage activity for fixed-rate 15-year term mortgages [FRM] has seen a spike in volume lately. The NYT, citing real estate consulting firm First American CoreLogic, reports that the number of 15-year mortgage loans issued in February jumped to 74,497 from 42,178 in January. According to Bloomberg, nearly $16 billion worth of 15-year mortgages were issued in March, more than double the $7.5 billion issued in February.

From The NYT: Brokers and mortgage industry executives say that these loans are becoming especially popular among people who want to shed debt more quickly…Because a 15-year loan also has 180 fewer interest payments than a 30-year loan, the borrower with that 15-year loan would pay $194,000 less in interest over the life of the mortgage.

…

[T]hose who receive [a 15-year FRM] face higher closing costs and must pay private mortgage insurance. On a $400,000 loan, that insurance adds $183 to the monthly payment, though it is tax deductible.

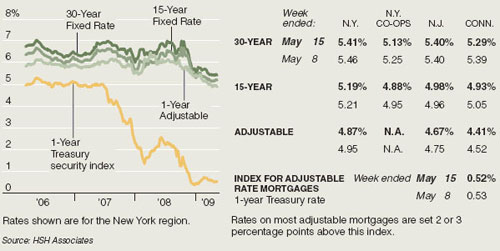

A series of decreases in the Federal interest rates over the last several months has significantly altered the type of mortgage borrowers are choosing. And that’s evident in the rise in 15-year fixed-rate loan activity.

Interest rates for the average 15-year, fixed-rate mortgage decreased from 4.5% to 4.44% earlier this week, compared with 4.69% for 30-year loans.

Graph: NYT

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply