Zygo Corp (ZIGO) has worked its way back into profitability and estimates are showing fantastic growth.

Company Description

Zygo Corp makes precision measurement solutions, medical lasers and other electro-optical devices for semiconductor, medical, scientific and industrial applications.

Back in the Black

On Aug 19 Zygo reported fiscal fourth quarter results that showed a 20% increase in revenues over the same period last year, to $28.5 million. Net earnings came in at $4.1 million. In the final period last year the company reported a net loss, even after stripping out massive one-time charges. This was the first quarterly profit in almost 2 years.

Earnings per shares were 23 cents, easily beating expectations of just 10 cents. Zygo has only missed expectations twice in the past 5 years.

Big Turnaround

Currently there is only 1 analysts covering Zygo, but that can be a benefit for us. With fewer eyes on the company, they have a better chance to post big surprises and subsequently big price movements.

That analyst raised the full-year fiscal 2011 estimate 18 cents, to 50 cents after the earnings report. Next year’s forecast rose 8 cents, to 68 cents. Last year the company lost 9 cents, making a good turnaround story.

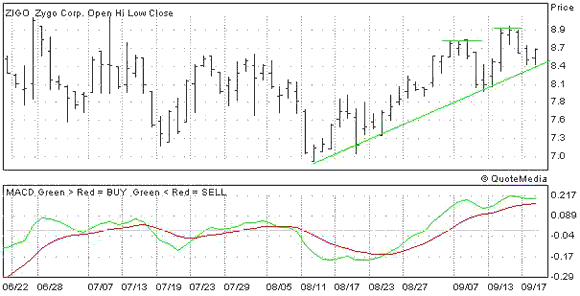

The Chart

Shares of ZIGO have a very nice upward trend going, starting from the earnings release. The stock continues to mark higher highs and as ZIGO hits the trend line here I am looking for yet another new high, making a great entry point.

ZYGO (ZIGO): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply