Finisar Corp (FNSR) jumped after reporting record-setting results. Additionally, the demand outlook remains strong, Cisco-induced worries.

Company Description

Finisar Corp makes fiber optic and network test systems for high-speed voice, video and data communications. The company’s products are used for networking, storage, wireless and cable TV applications.

Another Record-Setting Quarter

On Sep 2 Finisar Corp reported quarterly results that topped their previous record results. The company posted all-time highs for revenue, gross and operating margin and earnings per share.

Revenues came in at $208 million, up sharply from last year’s $129 million and up sequentially from $188 million. Earnings per share jumped 5 cents since last quarter, to 24 cents, beating the Zacks Consensus Estimate by 7 cents.

Comments from the company focused on a strong demand environment and adding capacity to meet the needs of its customers.

Analysts Love it

Following the earnings release analysts continued to push their full-year estimates higher. The Zacks Consensus Estimate for fiscal 2011 jumped 41 cents to $1.19.

Next year’s estimates are averaging $1.35, which is up 38 cents. The growth rate is exponential after Finisar earned just 14 cents last year.

Good Value as Well

Thanks to those drastic estimate revisions, shares are still trading with good valuations. The forward P/E is under 13 times and the PEG ratio of 0.8 is showing that the growth is coming at a discount

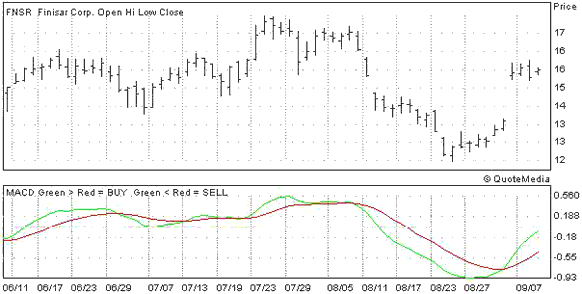

The Chart

Shares of FNSR took a big hit when industry giant Cisco missed revenue and gave a cautious outlook back in early August. However, the stock bounced right back after the great quarterly results that show demand is not in dire straights, as many anticipated.

FINISAR CORP (FNSR): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply