Dupont & Co. (DD) recently hit a new multi-year high at $42.75 after reporting a solid 24% Q2 earnings surprise in late July. With a dividend yield of 3.9% and rising estimates, Dupont has some very solid upward momentum

Company Description

Dupont & Co. is a conglomerate with seven operating segments; Agriculture & Nutrition, Electronics and Communication, Performance Chemicals, Performance Coatings, Performance Materials, Safety and Protection and Pharmaceuticals. The company was founded in 1802 and has a market cap of $39 billion.

With a highly diversified business model based on seven operating segments, DuPont provides broad exposure to a number of different industries. And with the general health of the economy on the mend from 2009, DuPont was well positioned to benefit, That dynamic played out in late July when the company reported better than expected Q2 results for its fourth surprise in as many quarters.

Second-Quarter Results

Revenue for the period was up 21% from last year to $8.6 billion. Earnings also came in strong at $1.17, 24% ahead of the Zacks Consensus Estimate, lifting the company’s average earnings surprise to 22% over the last four quarters.

DuPont saw strength in all segments, with each posting a double-digit sales gain from last year. The leaders of the pack were Electronics & Communications, Performance Materials and Safety & Protection, with volume up more than 25% in each group. Agriculture and Nutrition was up 16%.

Geographically, the company’s largest region, the US, saw solid 18% growth from last year. Its fastest growing region was Asia Pacific, where sales were up 47% from last year to $1.8 billion.

Estimates

We saw some solid upward movement in estimates on the good quarter, with the current year adding 35 cents to $3.02. The next-year estimate is up 30 cents in the same time to $3.23, a respectable 7% growth projection.

Valuation

With a forward P/E of 14X, shares of DD trade mostly in line with its peer average of 14.25X

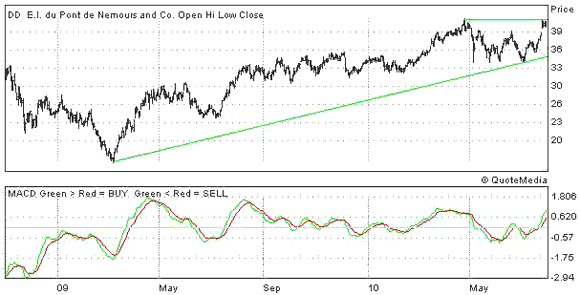

2-Year Chart

DD recently hit a new multi-year high after jumping higher on the good quarter. The MACD below the chart is bullish too, with the short-term average moving ahead of the long-term average. Look for support from the long-term trend on any weakness, take a look below.

DU PONT (EI) DE (DD): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply