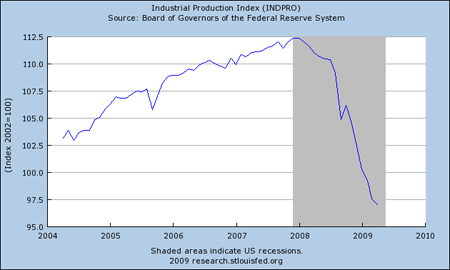

The Federal Reserve reported Friday that its index of industrial production fell another 0.5% in April, after having fallen 1.7% in March. Some analysts took comfort in the fact that at least the rate of decrease has slowed. But any decrease means we’re producing less than we did the previous month, and recovery requires growth, not a slower rate of decline.

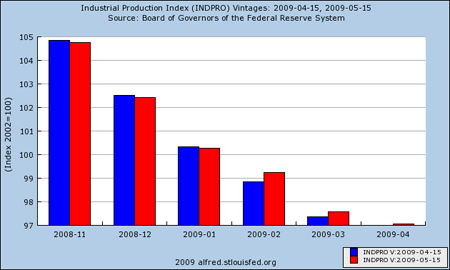

On the other hand, the levels for February and March were revised up from their earlier reported values, which is a positive development.

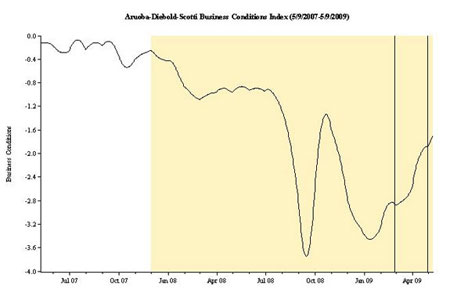

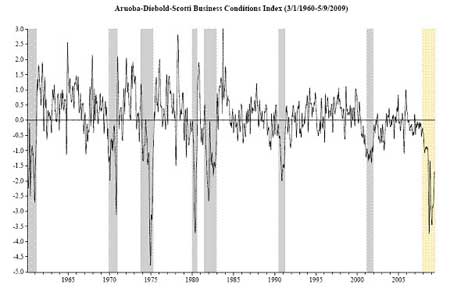

Those back revisions gave a boost the ADS Business Conditions Index. But I’m waiting for the backcast value of the index that is able to employ all 6 indicators (indicated by the leftmost vertical line in the second diagram below) to rise above -1% before interpreting this as an unambiguously favorable signal.

Meanwhile, across the pond euro-zone GDP fell 2.5% during 2009:Q1. Unlike the American convention, which would quote such numbers at an annual rate, the European number represents the actual quarterly loss, or a -10% annual growth rate. That is a staggering rate of decline, though not as bad as the 3.8% drop within the quarter experienced by Germany or the 11.2% quarterly drop in both Slovakia and Latvia.

Finally, let me mention here that Marc Wildi and Michel Philipp of Zurich University are also getting into the business of real-time business cycle dating algorithms.

Graphs: FRED, ALFRED, Aruoba-Diebold-Scotti Business Conditions Index.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply