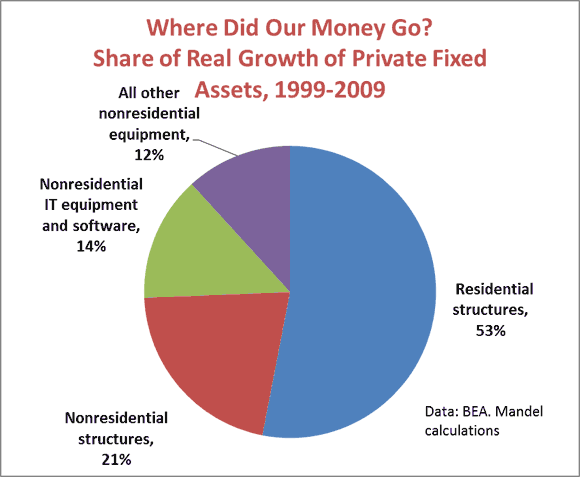

Here’s a chart that to me sums up the past decade. This was supposed to be the Information Revolution…but what we mostly did was build homes.

Private fixed assets are things like machinery, computers, factories, power plants, housing–all the privately-owned productive assets of the country. From 1999 to 2009, the real net stock of private fixed assets grew by 26%, the slowest 10-year increase in the post-war period, according to data from the Bureau of Economic Analysis.

That slow growth in real private fixed assets is bad enough. What’s worse, housing accounted for the majority, 53%, of the real increase in private fixed assets. By comparison, information technology equipment and software–computers, software, and communications equipment–only accounted for 14% of the increase in productive assets. If we toss in spending by on ‘communications structures’, that gets us up to 16%.

In any case, the net real increase in housing fixed assets was more than triple the net real increase in IT fixed assets. That may help explain why we are in such dire straits now—plenty of new homes, not enough investment in IT.

That’s why I’m not terribly concerned about the slow pace of recovery in the housing market. I’d rather see money go to more productive uses.

Some caveats: This analysis does not include government assets or consumer durables.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply