The World Gold Council’s latest quarterly recap of the gold market confirms much of the big-picture story we already knew: demand is strong (up 36 percent from a year earlier), supply is not keeping pace (up 17 percent), and global economic worries are driving investors toward gold as a safe haven.

Drilling down a little further turns up a number of interesting points:

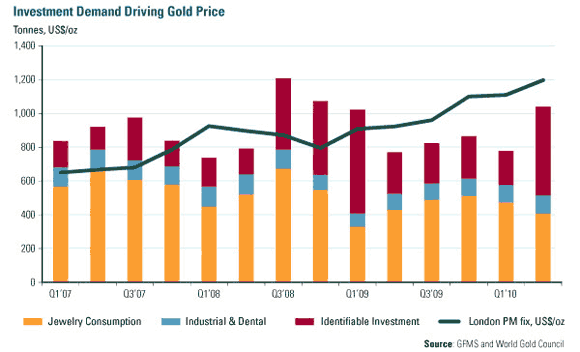

- Investment demand in the second quarter of 2010 (red bar in the chart) more than doubled compared to the same period in 2009, and accounted for more than half of total global demand. Investors bought the most gold since the first quarter of 2009, at the depths of the Great Recession.

- Demand from exchange-traded funds rose more than 400 percent to about 291 metric tons (9.4 million troy ounces), and retail investors bought about 30 percent more bars, coins and gold in other forms.

- Industrial demand is approaching pre-recession levels. The WGC credits the growing popularity of new consumer devices like iPads, Kindle electronic readers and netbook computers with driving this trend.

- Jewelry demand is down only slightly year-over-year, even though the gold price has risen from the $900+ per ounce range to $1,200 per ounce. In Hong Kong, for example, jewelry demand rose more than 30 percent in physical terms and nearly 80 percent in U.S. dollar terms.

The WGC says it foresees strong gold demand through the end of 2010, with India and China leading the way, along with concerns about economic recovery and the massive sovereign debt loads in Western Europe and elsewhere.

So far, August has been an unusually good month for gold – as of midday today, the price is up 6 percent this month, where historically the August price tends to rise only 2.5 percent above July.

We recently wrote about gold seasonality – September, just a few days away now, is on average the best month for both gold and gold equities. Learn why September means ready, set, gold!

We also have written about gold in the context of the global economic uncertainty and also about China’s important role in future gold demand.

Leave a Reply