China recently called for SDRs to replace the dollar as the international reserve currency and diminish the US economic supremacy. This column argues that because of the huge network benefits associated with using dollars, SDRs are not likely to supplant the dollar anytime soon as an international reserve unit, especially with the euro as a more viable competitor.

China wants a new international reserve currency, one that is “disconnected from economic conditions and sovereign interests of any single country.” It recommends resurrecting Special Drawing Rights (SDRs), a composite currency issued by the IMF, as a new international reserve unit.

While China claims that credit-based national reserve currencies are inherently risky, facilitate global imbalances, and foster the spread of financial crises, the key concern may be a bit more parochial. The country holds a huge official portfolio of dollar-denominated assets that could incur valuation losses if recent US actions to limit financial turmoil and stimulate the economy generated inflation and dollar depreciation (not unrelated to the problems France faced with its 1920s “sterling trap”).

Devil in the detail

- Adopting the SDR as a reserve asset is technically feasible, but it will not reduce the dollar’s role any time soon.

- People reap substantial economies from conducting cross-board commerce in dollars, and until the SDR matches these benefits – which is a long way off – central banks will still need dollars.

If anything, the euro is likely to challenge the dollar’s pre-eminence.

In the interim, countries that want to limit their exposure to credit-based reserve currencies, like the dollar, might simply allow their own currencies to appreciate.

Something old, something new

Complaints about the dollar and a fascination with SDRs are not new. The IMF created SDRs as an international reserve currency in the late 1960s to solve problems similar to China’s concerns that rose out of the Bretton Woods fixed-exchange-rate system. After World War II, the US dollar quickly emerged as the world’s key international currency, both as an official reserve unit and for financing international commerce.

Then, as today, countries accumulated reserves when they limited the appreciation of their currencies in the face of persistent balance-of-payments surpluses. Once acquired, official reserves then provided these countries with a buffer stock that they could draw down to mitigate the disruptive economic effects of unexpected balance-of-payments reversals.

Absent such reserves, these countries would either have to allow their currencies to depreciate or quickly tighten their monetary policies, but such abrupt adjustments might not be compatible with these countries’ current goals for inflation or real economic growth.

Dollar overhang and the closing gold window

By the early 1960s, many countries began to view their official dollar holdings as excessive. They worried that the US might be forced to devalue the dollar, saddling them with foreign-exchange losses. As the situation unfolded, some countries, led by France, sought to replace the dollar with a reserve currency unrelated to any single national currency, if not solely related to gold.

The IMF – then the guardian of the Bretton Woods parity grid – came up with the SDR. The IMF initially defined the SDR in terms of a fixed amount of gold, then equal to one dollar, and allocated 9.3 billion SDRs between 1970 and 1972 in proportion to member countries’ quotas in the IMF. On 15 August 1971, however, President Nixon closed the US gold window, refusing thereafter to convert dollars into US gold. By March 1973, the large developed countries had all allowed their currencies to float against the dollar, ending their need for any dollar reserves.

Despite the widespread acceptance of floating exchange rates, no country – including the US – has completely eschewed its portfolio of foreign-exchange reserves. Still, floating doomed the SDR. The IMF redefined the SDR as a weighted average of the US dollar, the British pound, the Japanese yen, and the currencies that eventually comprised the euro and made a second allocation of 21.4 billion SDRs between 1979 and 1981. Nevertheless, the SDR quickly devolved for the most part into a unit of account, primarily on the IMF’s books.

The dollar

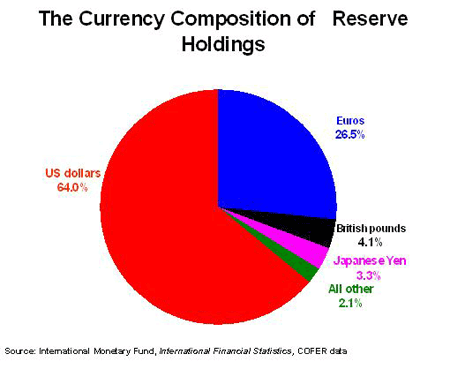

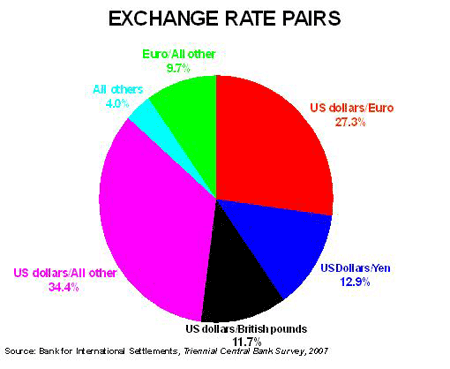

The dollar remains reserve currency of choice. The IMF estimates that 64% of the world’s official foreign-exchange reserves are held in dollar-denominated assets. The euro, the second most widely held international reserve currency, lags well behind, followed by the British pound and Japanese yen.

These currencies’ official reserve rankings parallel their status in international commerce more generally. This correlation should be of no surprise. Why hold a currency that no one uses? According to a 2007 BIS survey, roughly 88% of daily foreign exchange trades involve dollars. Again, the euro is a distant second, with the British pound and Japanese yen trailing.

Network externalities from dollar usage

The world reaps substantial economies from using dollars.

- Many foreign-exchange transactions, even ones not directly involving US residents, are denominated and undertaken in dollars.

- International trade in fairly standardised commodities and in products that sell in highly competitive markets is typically conducted in US dollars. Invoicing in a single currency helps producers keep their prices in line with their competitors and simplifies price comparisons across the different producers. Naturally, these invoicing gains rise with the number of producers.

In contrast, international trade in heterogeneous manufactured goods, where price competition is not as crucial, tends to be denominated in the exporters’ currencies, but even in these cases importers – or their banks – will often acquire the exporters’ currencies by first trading their home currencies for US dollars and then trading dollars for the exporters’ currencies.

Size matters

The dollar has maintained this role over the years, despite substantial fluctuations in its exchange value, because the size, sophistication, and relative stability of the US economy generally render the costs of transacting in US dollars lower than the costs of transacting in currencies that do not equally share these characteristics. In large part, the widespread use of the dollar developed and continued because the US has been the largest, most broad-based exporter and importer in the world. With a lot of Americans trading globally, a lot of dollars will naturally change hands. Because traders must finance a large portion of their business in US dollars, they maintain accounts, seek loans, and undertake myriad other financial arrangements in dollars.

A strong and open US financial system helped facilitate the dollar’s international use. While a high degree of feedback naturally exists between the dollar’s expanding role in trade and the growth of an accommodating financial structure, US financial markets have always been innovative and relatively free of cumbersome regulations. Their breadth and depth enhances the liquidity of dollar-denominated assets. Moreover, as dollar trade expands and US financial markets grow, more and more foreign financial firms – even ones not located in the US – offer dollar-denominated products. All this makes holding dollars convenient and transacting in dollars relatively easy.

As the global network for dollars expands, the benefits of using the dollar in exchange rise. The process is self-reinforcing. Moreover, once the network benefits of a particular currency become substantial, people are prone to continue using it, even if viable competitor exists. The debate on the SDR’s possible challenge to the dollar echoes many of the points made in the dollar-vs-euro debate. The euro matches many of the dollar’s qualities, and its use continues to expand. Making the jump to a new international currency, even one as widely used as the euro, requires a substantial proportion of people to make the jump in close concert. Otherwise, the network benefits are lost. For that reason, the world is not likely to shift quickly away from dollars even if the SDRs become a new international-reserve option.

What’s a country to do?

Of course, if foreigners suspected that the costs of holding dollars in terms of lost purchasing power would soon exceed the network benefits of transacting in dollars, they might quickly migrate to an alternative international currency. At its core, China’s SDR plan may reflect a fear of US inflation. As Chinn and Frankel (2008) argue, the likely candidate is the euro, not the SDR.

In the meantime, countries – like China – that worry about their expanding dollar portfolios have another option – allow their currencies to appreciate.

Between mid-1995 and mid-2005, China pegged the renminbi to the dollar and bought dollars flowing into China through trade and investments. Had China not done so, the renminbi would have appreciated against the dollar, until the dollar inflow stopped. Between mid-2005 and mid-2008, China allowed the renminbi to appreciate against the dollar, but continued to limit the renminbi’s appreciation. Recently, the renminbi has remained little changed relative to the dollar. All this is fine; many countries manage their exchange rates, particularly to avoid appreciations, but accumulating a foreign-exchange exposure is a cost of doing so.

References

Bennett T. McCallum, “China, the US Dollar, and SDRs” presentation at the Shadow Open Market Committee, 24 April 2009, Washington, D. C., Cato Institute.

Linda Goldberg and Cedric Tille, “Vehicle Currency Use in International Trade”, Journal of International Economics forthcoming.

Menzie Chinn and Jeffrey Frankel. “The Euro May Over the Next 15 Years Surpass the Dollar as Leading International Currency”. 2008.

Zhou Xiaochuan “Reform the International Monetary System” People’s Bank of China, March 3, 2009.

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply