From Ian Ayres at the Freakonomics Blog on December 24, 2008:

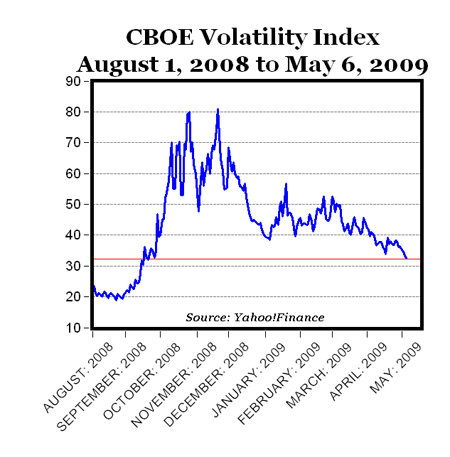

One of the most important but underreported financial indicators is the CBOE’s Volatility Index (^VIX), which measures the market’s expectation of future volatility in stock prices. (The CBOE has written a nice technical paper describing how it is calculated here.) Traditionally, the annualized volatility of the S&P 500 has been 20%, but in both October and November the VIX reached an apocalyptic 80%. The huge drop in stock prices is bad, but it would be a lot better if the market thought that the major gyrations were mostly in our past. So the good news is that the volatility index has retreated to 45%.

Now, 45% is still more than twice what it “should” be. But it’s at least moving in the right direction. When it drops below 30%, it will be a strong indication that the market correction is complete and we’re back to business as usual.

MP: The CBOE Volatility Index closed today at an 8-month low of 32.45%, the lowest level since mid-September 2008 (see chart above), and more than 48 points below the November 20 peak of 80.86. If Ian Ayres is correct, market volatility is within a few points of the 30% reading that will signal that the market correction is complete.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply