Wyndham Worldwide (WYN) and analysts are bullish on the future for the global hotel company.

Company Description

Wyndham Worldwide has about 7,200 hotels world wide in addition to a 3.8 million member Exchange & Rental program with more than 80,000 locations.

Rising Revenues

On Jul 28 Wyndham Worldwide reported second-quarter results that included revenues of $963 million, a 5% improvement since last year. This drove net income to a 34% jump, up to $95 million.

Earrings broke down to 51 cents per share, topping the Zacks Consensus Estimate by a dime. Wyndham Worldwide has beaten expectations in each quarter since its IPO in the summer of 2006.

Optimistic Outlook

In the same release Wyndham Worldwide ratcheted up its full-year outlook. The company now expects revenues to land between $3.7 and $4.0 billion, up $100 million on both ends of the range. Wyndham Worldwide raised the earnings estimate to $1.78 to $1.88, from $1.56 to $1.71.

Analysts unanimously raised estimates, with the Zacks Consensus Estimate for 2010 coming in at $1.87, up 18 cents. Next years average forecast is up 12 cents to $2.01.

If Wyndham Worldwide can meet these goals, year-over-year growth rates will be 4% and 7%, respectively.

Comparison

Hotels are surprisingly a hot industry, ranked 33 out of 264 areas on Zacks.com. Wyndham Worldwide is the top rated company in that space occupied by 13 others.

The company has a net profit margin of 8.5% while its peers average break-even levels. Wyndham Worldwide’s ROE is 12.8%, easily ahead of the 3.4% industry average.

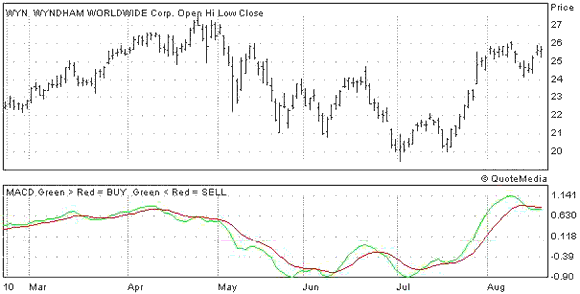

The Chart

Shares of WYN surged on the quarterly report and the stock is now just under the multi-year high.

WYNDHAM WORLDWD (WYN): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply