Cinemark Holdings, Inc. (CNK) recently broke a short-term down trend after reporting better than expected Q2 results in early August. But in spite of the solid quarter and upward momentum, shares still trade at a discount to their peers.

Company Description

Cinemark Holdings, Inc. and its subsidiaries own and operate 424 movie theatres in the United States, Canada and Latin America and has a market cap of $1.79 billion.

Our most recent look at CNK came on August 5 when the company reported better than expected Q2 results.

Second-Quarter Results

Revenue for the period was up 4.2% from last year to $539 million. Earnings came in even better at 35 cents, 46% ahead of the Zacks Consensus Estimate, shifting the company’s average earnings surprise over the last four quarters to 58%.

Commenting on the good quarter, CEO Alan Stock noted that this was the seventh consecutive quarter that the company’s domestic box office outperformed the industry.

Also of interest, Cinemark continues to invest in 3D development and expansion, with plans to install 3D systems in 40%-50% of its global screens.

Balance Sheet

Cinemark also continues to work on its balance sheet and chip away at its debt load, with total debt down $33 million from last year to $1.677 billion against cash and equivalents of $436 million, up 53 million from last year.

Estimates

Estimates had been grinding higher into the number, with the current year up 10 cents in the last month to $1.20. The next-year estimate is pegged at $1.32, a solid 10% growth projection.

Valuation

The valuation picture looks pretty solid here too, with a forward P/E of 13X against its peer average of 15X.

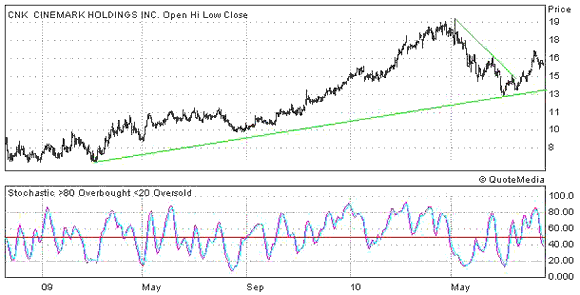

2-Year Chart

On the chart, CNK recently broke a down trend that had been pressuring shares since lat May, keeping the long-term trend in tact. Take a look below.

CINEMARK HLDGS (CNK): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply