Kulicke & Soffa Industries, Inc. (KLIC) is dirt cheap at just 3x forward earnings despite recently posting a big earnings surprise.

Kulicke & Soffa manufactures semiconductor assembly equipment. Its products include ball banding, die bonding, wedge bonding, manual bonding systems and dicing blades.

Kulicke & Soffa Beat By 38.5% in the Fiscal Third Quarter

On Aug 4, Kulicke & Soffa reported its fiscal 2010 third quarter results and blew by the Zacks Consensus by 20 cents. Earnings per share were 72 cents compared with the consensus of just 52 cents.

Revenue jumped 325% to $221.3 million from the third quarter of 2009 and was also up by 44% from fiscal Q2 of 2010. The quarter was boosted by the equipment business which grew about 50% compared to the second quarter as IDM and subcontractor customers increased demand.

Other segments also saw strong results in the third quarter including ball bonder shipments for LED applications which doubled over the second quarter.

Outlook for Fiscal Fourth Quarter and Beyond

The company was optimistic that it would continue to see strong demand in its fiscal fourth quarter of 2010. It issued revenue guidance in the range of $250 million to $260 million.

Kulicke & Soffa also sees its first quarter of fiscal 2011 (the December quarter) coming in around the same range in revenue, though the company did say it is too early to give actual guidance.

Zacks Consensus Estimates Jump

Given the big quarter beat, the analysts all moved to raise fiscal fourth quarter and full year estimates.

The fourth quarter Zacks Consensus jumped by 45% to 81 cents in the last week as all 4 estimates moved higher.

The fiscal 2010 Zacks Consensus also saw all 4 estimates climb which boosted the consensus by 31 cents to $1.95 per share in the last week.

This is earnings growth of 346% as the company lost 79 cents in fiscal 2009.

However, analysts are less enthused about fiscal 2011, as earnings are expected to contract by 12%.

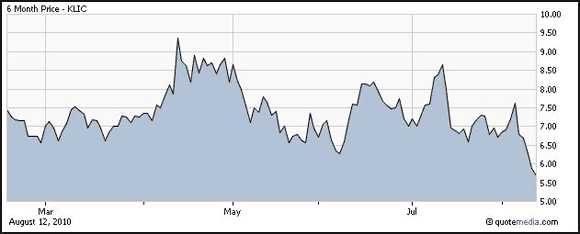

Stock Down Sharply on an Analyst Downgrade and Tech Weakness

On Aug 6, the BAC/Merrill Lynch analyst downgraded the stock to Underperform from Buy on worries over Kulicke maintaining its top-line momentum into fiscal 2011 given the current stage of the semiconductor cycle.

The downgrade hit the stock hard and it has continued to sell off in the last few sessions which has made Kulicke even cheaper on a P/E basis. You can see the sell-off in the 6-month chart.

Kulicke & Soffa Is an Extreme Value Stock

By every metric, Kulicke & Soffa qualifies for the title “value stock”. It is easily trading within the value parameter on all the metrics and is well below its own peers as well.

Not only is its P/E ratio low, but it has a price-to-sales ratio of just 0.7 whereas its peers trade at 1.5.

The company has an impressive PEG ratio of 0.2 and its peers are at 0.5. Investors are seeing a great return on equity of 53% which easily beats its peers who are averaging 18.5%.

Kulicke & Soffa is a Zacks #1 Rank (strong buy) stock.

KULICKE & SOFFA (KLIC): Free Stock Analysis Report

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply