The Trade Deficit came in much worse than estimated when the GDP number of 2.4% annualized was released ten days ago: -$50B vs estimate of -$42B, an $8B drop from May’s -$42B deficit. This is the worst trade deficit since Oct 2008. It is likely that JP Morgan (JPM) will revise downward again, from 1.3% to 0.9%.

The Trade Deficit came in much worse than estimated when the GDP number of 2.4% annualized was released ten days ago: -$50B vs estimate of -$42B, an $8B drop from May’s -$42B deficit. This is the worst trade deficit since Oct 2008. It is likely that JP Morgan (JPM) will revise downward again, from 1.3% to 0.9%.

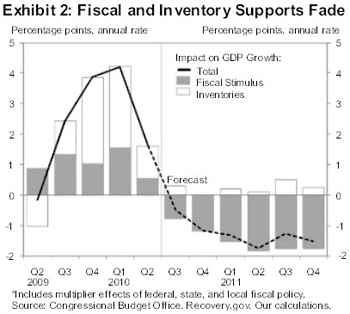

The Stimulus is now becoming a drag, as it has passed peak spending and is decreasing each quarter; as is inventory rebalancing (see chart courtesy Goldman Sachs). Goldman sees the drag as peaking at -1.7% in 2011. Absent some sort of tax cuts (not increase next year, as is now baked in with the expiration of the Bush tax cuts), they are close to joining the double-dip camp. As it is, they have reduced their 2011 GDP estimates by 0.9%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply