Linear Technology (LLTC) received a rush of estimate revisions following its latest earnings release, sending the consensus higher.

Company Description

Linear Technology Corp makes integrated circuits for telecom, PC, automotive, military and other applications.

Profit Surges

On Jul 20 Linear Tech announced quarterly earnings of $124.5 million, more than double the $51.4 million a year ago. Revenues for the fiscal fourth quarter were up 76% to just over $366 million.

Earnings per share broke down to 54 cents, beating the Zacks Consensus Estimate by 3 cents. This market the tenth consecutive earnings surprise and you have to go back to 2006 for the last miss.

Additionally, Linear Tech said it expected revenues to grow 4-7% this year, which puts the lower end of the range at $365 million, more than $20 million of the estimates at that time.

Analysts Love it

Leading up to and after the quarterly report, we have received 27 upward estimate revisions for the current fiscal year. Linear Tech is now expected to earn $2.42, up 31 cents.

Next year’s estimates are averaging $2.57, up 32 cents. If those levels are reached the year-over-year growth rates will be 50% and 6%, respectively.

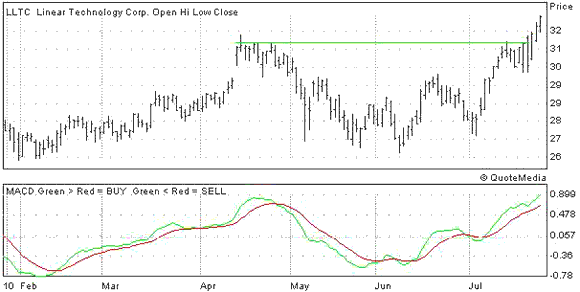

The Chart

Shares of LLTC jumped to a multi-year high following the earnings release. However, they are still trading at only 13 times forward estimates.

Leave a Reply