Last Friday, the U.S. Bureau of Labor Statistics (BLS) reported that the consumer price index (CPI) declined in June for the third consecutive month. And although core inflation edged up a bit, the entire increase can be accounted for by the BLS’s seasonal adjustment factor. In an environment of “business-not-as-usual” like today, data driven by seasonal adjustment are certainly suspect. So overall, the June CPI news seems largely in line with the downward inflation trend we’ve been seeing for a while.

Does recent disinflation imply deflation? Well, that wouldn’t be the consensus coming out of the June 22–23, 2010, FOMC meeting minutes:

“A broad set of indicators suggested that underlying inflation remained subdued and was, on net, trending lower,… However, inflation expectations were seen by most participants as well anchored, which would tend to curb any tendency for actual inflation to decline.”

A similar sentiment was expressed recently by European Central Bank (ECB) President Jean-Claude Trichet in describing the ECB’s view on inflation expectations:

“Inflation expectations remain firmly anchored in line with our aim of keeping inflation rates below, but close to, 2% over the medium term.”

Of course, how firmly something is anchored has meaning only relative to the forces working to move that anchor. Being well anchored against a five-knot drift isn’t exactly the same as being well anchored against a 10-knot current. But assuming the idea here is that expectations are likely to hold against the usual range of events one might expect in an environment like ours, we can ask the question: How does one judge whether expectations are well anchored?

Presuming this analogy, one way we might gauge how anchored inflation expectations are is to monitor the behavior of inflation expectations relative to recent shocks. By this standard, expectations seem rock-solid. Virtually every measure of inflation expectations has held steady against the tug of widely fluctuating commodity prices, persistent retail disinflation, expansion of the central bank’s balance sheet, large current and projected fiscal imbalances, and the general economic and financial volatility of the past few years.

But economists know very little about how expectations are formed and, therefore, we don’t know what sorts of events are likely to pose the greatest threats to the expectations’ anchor. In other words, we may not know when inflation expectations are likely to move until, well, they actually move.

In an attempt to get a more direct read of inflationary sentiment and to put more light on how inflation expectations are formed, the Federal Reserve Bank of Atlanta is looking into polling businesses about their inflation expectations. With help from the folks at Kennesaw State University (a very big hat-tip to Don Sabbarese and Dimitri Dodonova, who compile the Georgia and Southeast Purchasing Managers’ Indexes) we asked a group of purchasing managers a handful of questions related to the inflation outlook. The poll was conducted during the week of July 7–July 13, and 32 respondents answered the call. Here’s what we learned.

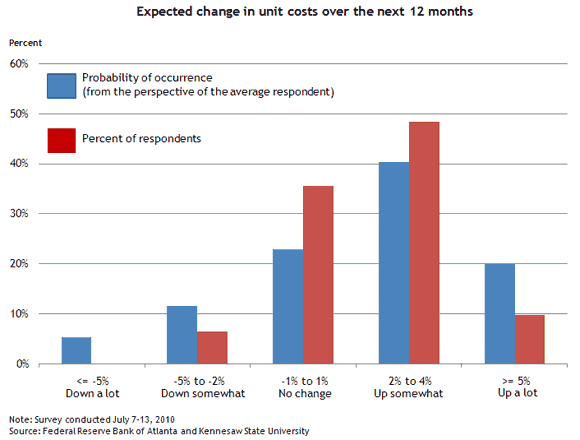

Over the next 12 months, this sample of purchasing managers expects unit costs to increase 1.7 percent, just a shade higher than the consensus CPI forecast of economists. The distribution of the poll responses is represented by the red bars in the chart below. About half of the respondents saw unit costs rising “somewhat” defined by the range of 2 percent to 4 percent, while about one-third of the respondents indicated they expect virtually no change in unit costs over the period.

But what probability do respondents attach to their expectations? It turns out that some respondents have great confidence in their expectation for unit cost changes—they assigned little chance that unit labor costs would do anything other than what they forecast. But most purchasing managers attached a significant likelihood to a large range of possible outcomes. We show the distribution of the average respondents’ expectation for unit costs by the blue bars in the chart. So, keeping in mind that the mean expectation of the group was for unit costs to rise 1.7 percent, respondents on average assigned a 17 percent chance that unit costs could decline over the coming year, while they put an equally large likelihood of inflation at 5 percent or more (20 percent).

What does all this mean for the inflation outlook? Well, first, let us caution that a sample of this size doesn’t lend itself to any strong conclusions, and these data will have to be carefully evaluated in light of other poll questions and against other benchmarks. Those important caveats aside, we can say that while the average purchasing manager in our poll is expecting price pressures that pretty closely correspond to the Federal Reserve’s long-term inflation projection, this group attaches significant upside and downside risks to the inflation outlook.

Have any thoughts about how we proceed from here? We’d love to hear your ideas. The next poll will be sent to potential respondents in about three weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply