What a rubbish week.

Markets have been dominated more by positioning than so-called fundamentals, Macro Man’s carefully-constructed has seen its correlation structure go awry, and he’s bled away the accumulated work of the previous three weeks.

So he’s understandably lacking in inspiration.

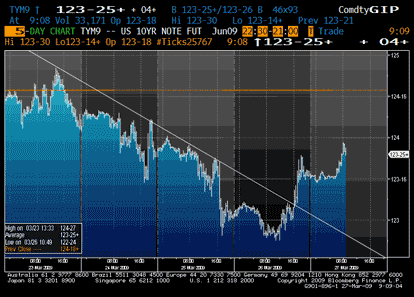

Look at Treasuries, for example. As Macro Man observed a couple of days ago, if you bought after the FOMC announcement, you lost money. Going into yesterday’s seven year auction, the “ten year” future (which is really a seven year future) fell enough to take out most of the longs…including your frustrated scribe.

So naturally, the auction went much better than the earlier five year auction, futures rallied smartly, and now markets are looking at several buyback sessions before the next bout of supply.

Should Macro Man have expected this? Yeah, maybe. But when everything else is going awry, it’s pretty natural to excise the most obvious losers. That’s the way you keep a small drawdown from turning into a hemorrhage.

Perhaps the difficulty that Macro Man is having is that markets have, in a sense, caught up to his bearish worldview. While it is true that some pieces of data have turned around in an absolute sense, albeit in very modest form (and well within the boundaries of statistical noise), the real issue is that the outturns are no longer disappointing expectations.

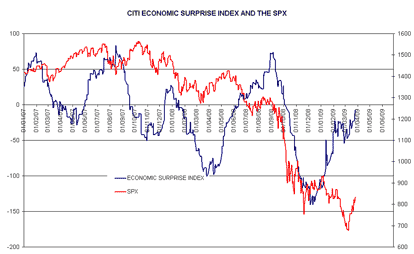

Citigroup is one of a number of institutions that calculates an “economic surprise index”, which measures data outcomes relative to consensus expectations. The real economy aftershock of the Lehman collapse generated a steady skein of worse-than-expected data. More recently, however, analysts seem to have “caught up”, and so far this year the data has, in aggregate, come out in line with expectations.

While this more balanced data outturn may have contributed to the recent bounce in stocks, Macro Man has been unable to extract a consistent forecasting relationship between the surprise index and future equity returns.

So it’s back to the drawing board. Perhaps the best thing for Macro Man to do is to keep his head down, write off the next two days’ price action as month end paper-shuffling, and get ready for an April that will hopefully offer a bit more signal and a bit less noise.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply